Property Tax is a type of tax levied on the estate/ property in the form of an annual charge. This type of tax is obtained from institutions, estate properties, commercial. The body responsible for managing such taxes is the local municipal corporation. The municipal corporation is responsible to levy appropriate charges on the estate as per the type of property, its value, rate of taxation and the method of valuation.

Table of Contents

AP Property Tax

All of these property taxes are used in managing our surroundings and keep in line with the services/ basic comforts for the people. All these facilities include roads, water, drainage, buildings, parks, etc. Thus, property-related taxes are also due to the Municipal Corporation. With the advent of technology, payment of such taxes has become easier with time. The state of Andhra Pradesh also offers payment of these taxes through the online portal of CDMA.

In this article, we will share information about the Andhra Pradesh Property Tax Service under the CDMA portal of the Andhra Pradesh Government. We share insights on the portal services and discuss in detail the property tax for the state. Readers will get all the relevant information on the Property tax application status, online dues payment, self-assessment, revision, petition, mutation, etc. Thus, readers of this post are advised to read the article till the end.

Key Points of AP Property Tax Payment, AP House Bill

| Article Category | AP Government Schemes |

| Name | Andhra Pradesh Property Tax |

| Department | Municipal Administration Department |

| Apex Authority | Commissioner and Director of Municipal Administration |

| Portal Type | Online Multiple Service portal |

| Status of the Portal | Active |

| Launched by | Government of Andhra Pradesh |

| Services Offered | Online dues, application status, self-assessment, etc. |

| Service Types | Application/ Payment of due taxes, filing mutation, filing revision petition, self-assessment, etc. |

| Official Website | www.cdma.ap.gov.in |

AP Property Tax Application Payment

Property taxation is an essential process under any municipal body. All the urban local bodies (ULBs) under the state have property tax as the major source of revenue. This property tax is imposed on all the properties/estates under the jurisdiction of the Urban Local Bodies. The property owners of all such estates are liable to pay the tax to the respective Urban Local Body/ Municipal Corporation.

This tax is payable by the owner of the property/ estate every year. Any changes to the tax assessment are made by the Town planning Department. Although, all the taxation is levied by the Municipal Administration Department functioning under the Government of Andhra Pradesh (GoAP). The Commissioner and Director of Municipal Administration serve as the highest authority. The department administers all the municipalities/ municipal corporations. Thus, ensuring effective administration under the state.

The state of Andhra Pradesh contains 14 corporations with 96 municipalities/ Nagar panchayats. The Directorate of Municipal Administration functions with the help of Regional DMA and Urban Local Bodies. The Directorate of Municipal corporation (DMA) for the state of Andhra Pradesh is responsible for various function management of the ULBs. Some of these functions are:

- Civil/ Public work implementation

- Project implementation

- Tax collection

- Scheme implementation

- All other public services

Procedure to Pay AP Property Taxes Online

For all the functions related to the taxation and assessment, the owner of the estate/ property first needs to register his estate under the Urban Local Body. The Revenue department of the ULB manages the services related to taxation. The respective ULB will manage the taxation for the estate under its jurisdiction only. The estimation of the taxes will entirely be based on parameters like:

- Property dimension

- Zonal Location of the property

- Status (residential/ non-residential)

- Property age

- Plinth Area

- Type of Construction

- Any other condition specific to a particular estate

AP Property Tax Payment Methods

With the advancement in technology, property taxes are also payable online now. Any citizen of the state can pay his/ her property-related taxes online through various ways, like:

- Payment on the ULB Counter

- Through the AP Online/ Meeseva portal

- Puraseva App

- Official Portal of CDMA @cdma.ap.gov.in

Andhra Pradesh Digital Panchayat

Online Services of Property Tax Andhra Pradesh

The AP cdma portal of the Andhra Pradesh Government provides services related to property taxation. To avail of the services of Property Tax on the CDMA Portal, users can visit the official portal of the department and click on the tab ‘Online Services‘ available on the homepage.

The portal also contains some other online services like:

- Advertisement Tax

- Birth and Death Registration

- Circulars and Orders

- Common Application for water and Sewerage

- Land Tax

- Marriage Registration

- Property Tax

- Online Building/ Layout Permission

- Water Charges

- Sewerage Connection

- Tree Felling Permission

- Trade License

- Grievance

Online Due Payment cdma.ap.gov.in

The portal of CDMA allows the citizens of Andhra Pradesh to pay their due bills for Property taxes online through the portal. You can check for your dues and pay them online only. The portal also contains Quick Pay for the payments on the portal. Citizens can pay their dues by choosing their district and the municipality covering the area where the property is located. To make due payment for your property taxes online, through the official portal, users can follow these steps:

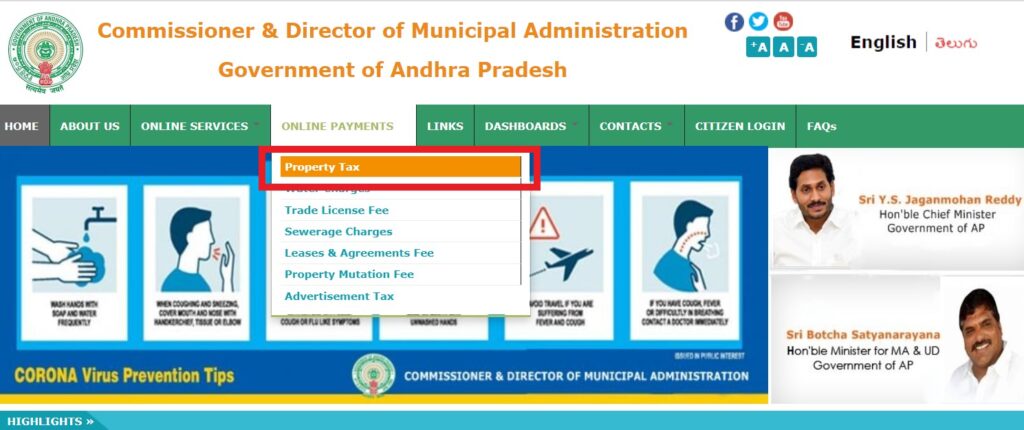

Step 1: Go to the official website of the CDMA, Andhra Pradesh. On the homepage of the portal, there will be a tab of Online Payments on the menu bar.

Step 2: Under the Online Payments, users will also see an option of ‘Property tax‘. Click on that option. Users will now be directed to another page.

Step 3: On the redirected page, users will have to choose their district, municipality/ Nagar Palika/ corporation and select the payment type. After selecting all the options, users will have to click on the Submit button.

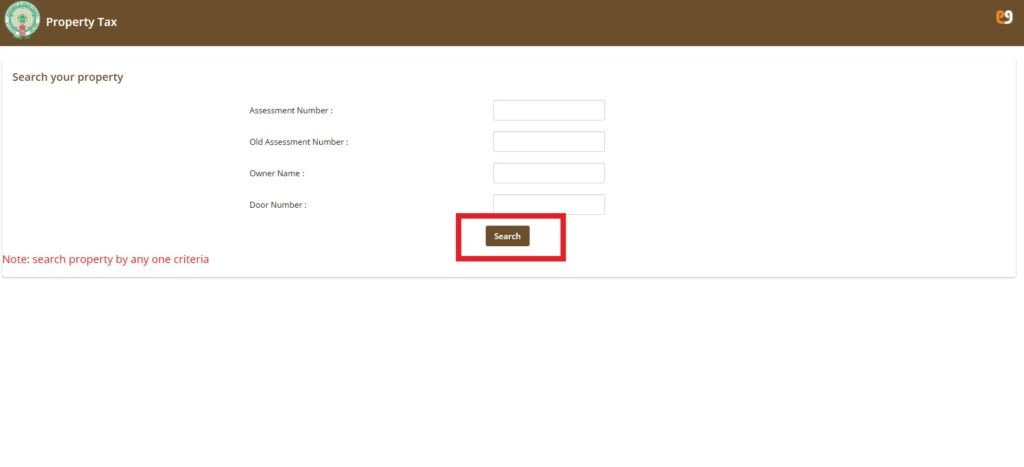

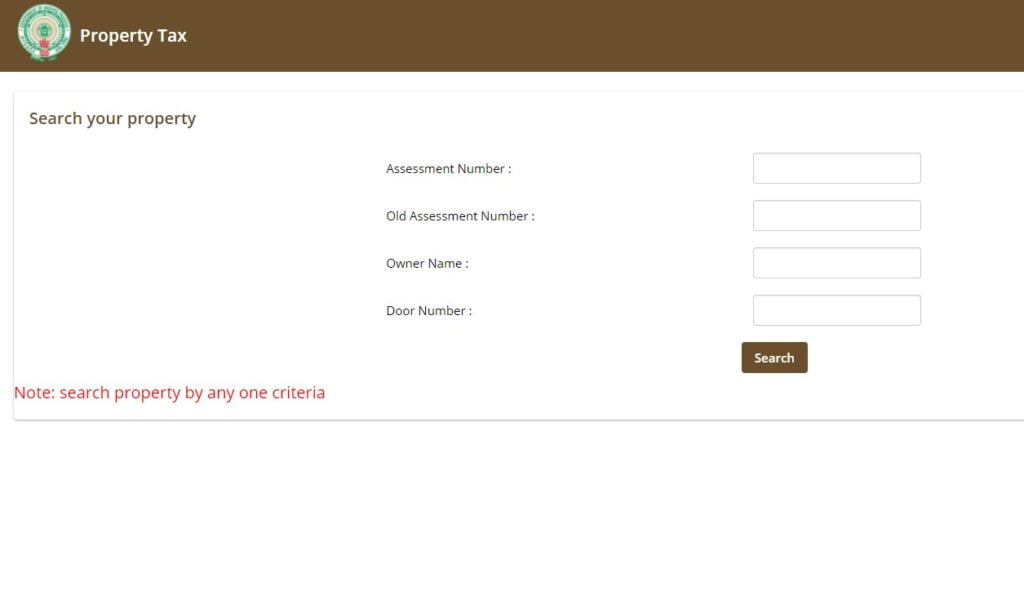

Step 4: As the users submit the information, they will be directed to the next page where the citizen will have to search the property for which they want to make the payment. Users will have to enter the assessment number, name of the owner and door number. After that, click on the Search button and proceed further for the payment.

All the other process related to the online due payment on the portal has been detailed in the subsequent sections of this article. A direct link to the online payment is also available at the end of this article.

How to check AP Property Tax dues?

The portal of cdma offers the estate owners to view and pay their tax dues. Any citizen who wants to view his/ her tax dues, if any, can do so by following the steps listed below.

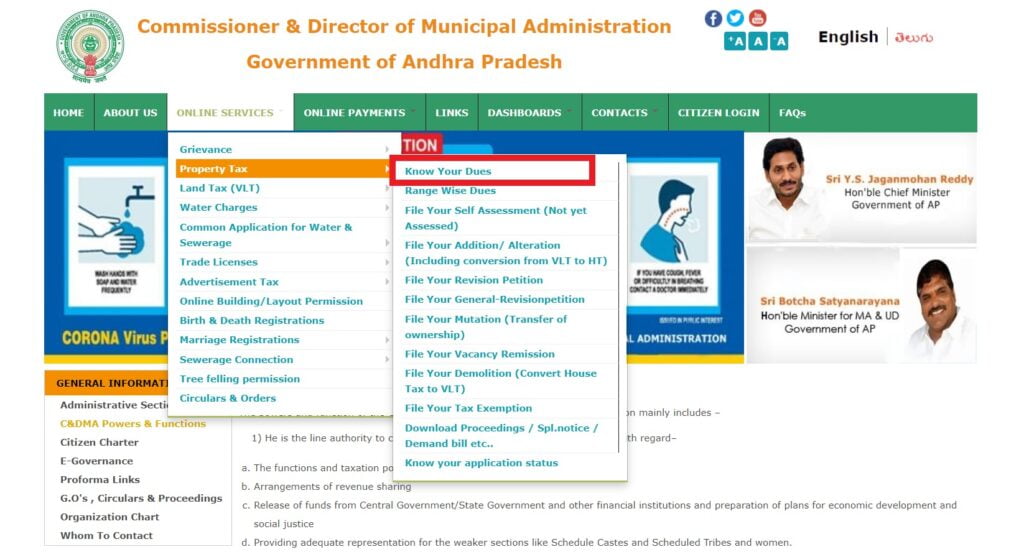

Step 1: Visit the official website portal of the Commissioner and Directorate of Municipal Administration (CDMA). On the homepage of the portal, citizens will see an option of ‘Online Services‘. Click on that option.

Step 2: Clicking on the option, a drop-down list will appear on your screen. From the list, tap on the option of ‘Property Tax‘.

Step 3: As you tap on the option, the aside list will open up with a list of more options. Click on ‘Know your Dues‘.

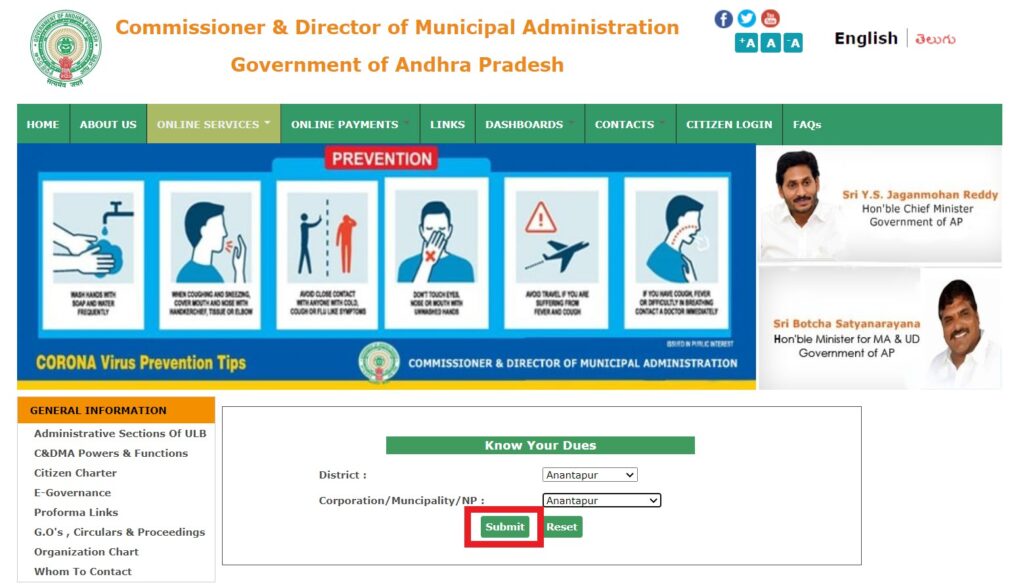

Step 4: You will be directed to a new page. On this page, choose the name of your district and the name of your municipality/ Nagar Palika/ Municipal Corporation. After adding the names, click on the Submit button.

Step 5: A new page will open, where you have to enter your assessment number, old assessment number, name of the owner and door number. Enter all the details and click on the Search button.

Check Range Wise Dues

Users on the portal can avail of the facility to check the range wise dues. To check it, users can follow these steps:

- Click on the Property Tax option under the Online Services tab on the homepage of the portal.

- On the open list, click on the option of ‘Range wise dues‘.

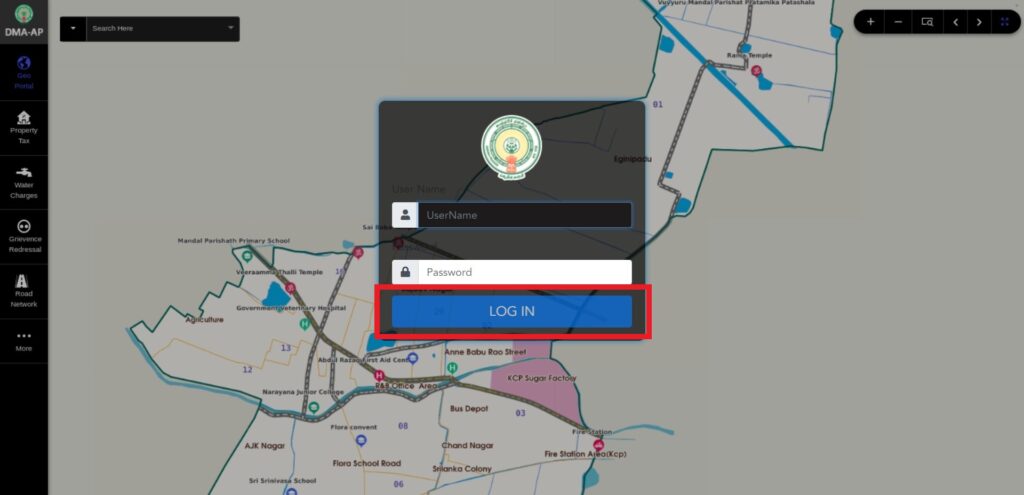

- A new page will open up, where you need to login with your username and password.

- Enter your Username, Password, click on the ‘LOGIN‘ button and continue.

Self Assessment Tax Payment AP Property

Self Assessment taxes play a major role in completing the tax dues of any citizen. Such tax is all the extra/ remaining taxes apart from the TDS and Advance taxes. All of these taxes are levied on the accessed income of the citizen. Thus, whenever filing a return, self-assessment is essential. Thus, the return will not be submitted until all the taxes have been paid. Self Assessment Tax is also known as SAT. It covers tax payment for other income sources.

How to file Self assessment?

If you are a citizen of Andhra Pradesh and want to file a self-assessment, you may do so with the cdma portal of the government. To file a self-assessment for an un-accessed tax, users can follow the steps given below.

Step 1: Go to the official portal of the Andhra Pradesh CDMA. On the portal homepage, click on the Property tax option under the Online Services tab.

Step 2: On the open list, tap on the option displaying ‘File your Self Assessment (not yet accessed)‘. Clicking on it you will be directed to another page.

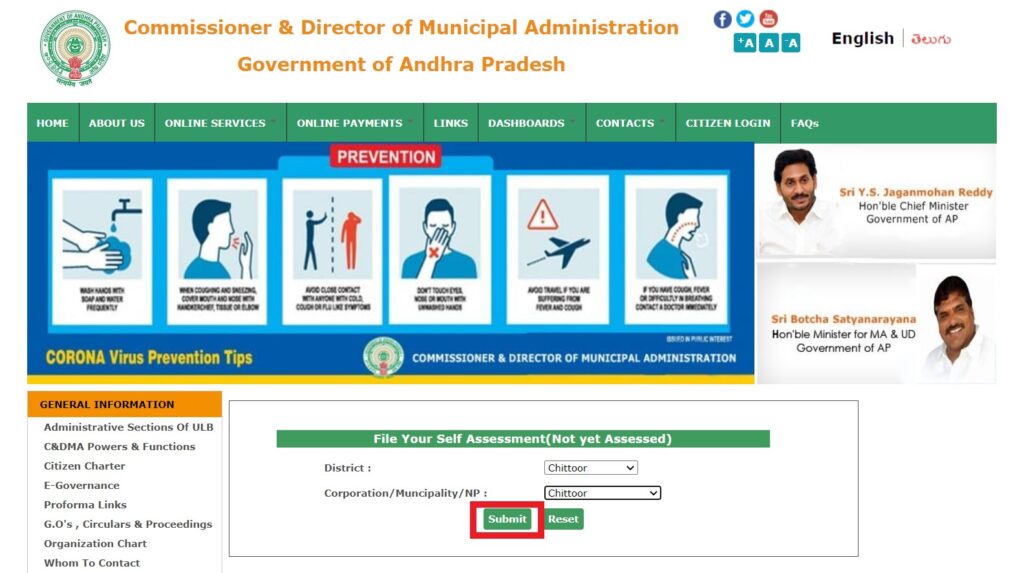

Step 3: On the newly open page, you will see a section to file your self-assessment. Choose your district and Nagar Palika (NP)/ Municipality/ Corporation in the given boxes. Click on the Submit button.

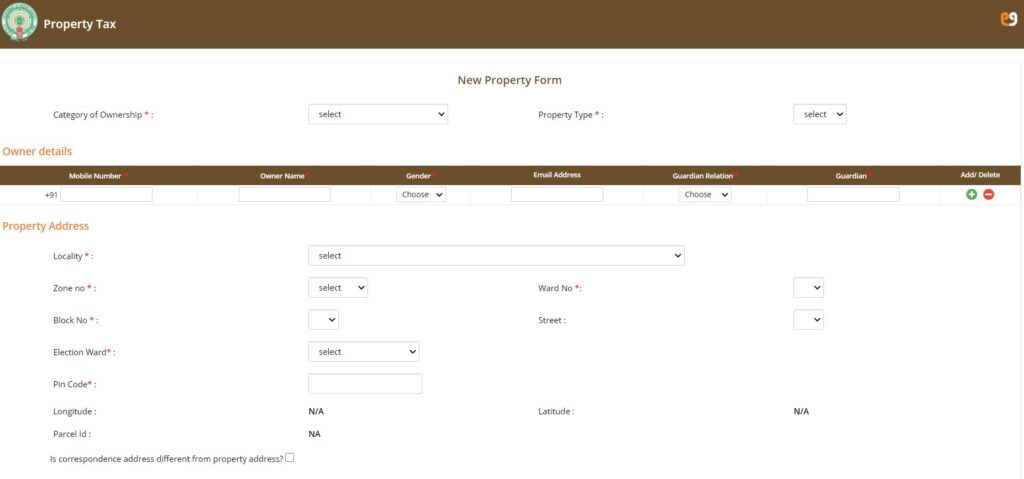

Step 4: Clicking on the option, a new page will open titled ‘New Property Form‘. Fill in the owner details, property address, Assessment details, amenities, construction types, floor details, vacant land details, surrounding properties and document related details. Click on ‘Show tax‘ to know your estate tax.

Step 5: Upload all the documents asked in the application form. The documents will be modified as per the ownership and the type of property one owns. Click on the ‘Forward‘ button located at the end of the form.

Filing of Addition/ Alteration

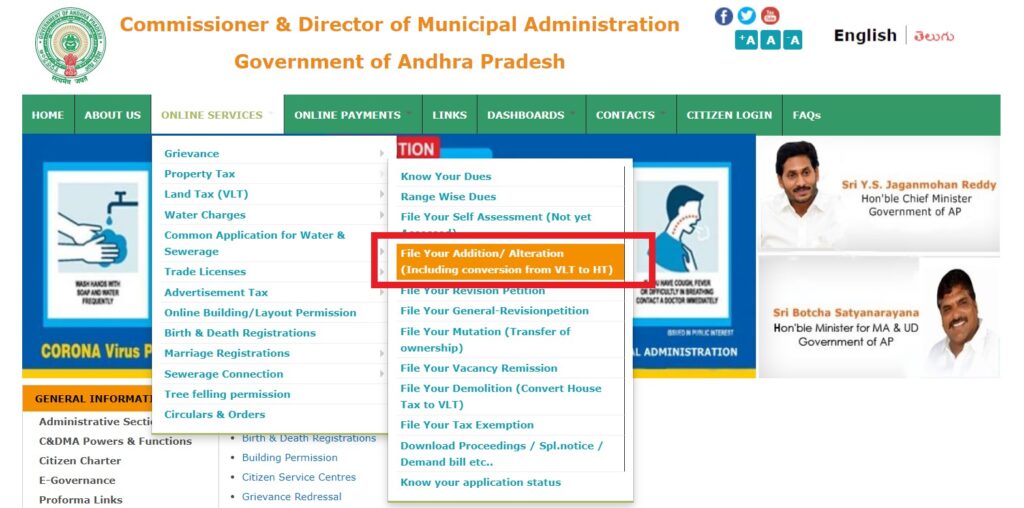

To file any addition/ alteration, citizens can follow these steps:

- Click on the Property Tax option under Online Services, on the homepage of the portal.

- On the open up, drop-down list, click on the option of ‘File Your Addition/ Alteration (Including conversion from VLT to HT)‘.

- Clicking the option, citizens will be directed to another page.

- On the new page, choose your district name and Nagar Palika or Corporation or Municipality. After choosing these details, click on the ‘Submit‘ button.

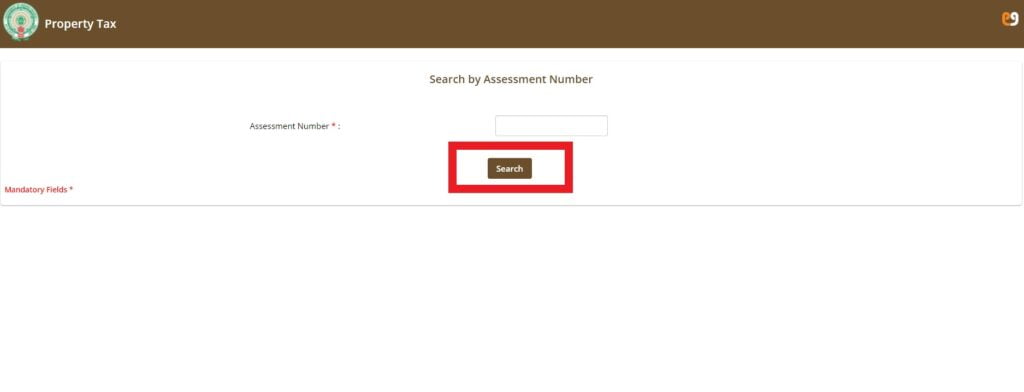

- A new page will open titled ‘Search by Assessment Number‘. So, enter your assessment number and after that, click on the Search button.

AP Property Tax File Revision Petition

If in any case, the citizen performing the assessment realises that the assessment forward by the higher authority is not accurate as per your provided information. Then, the citizen can file for a Revision. To file a revision under the Andhra Pradesh Property Tax Authority, citizens can follow these steps:

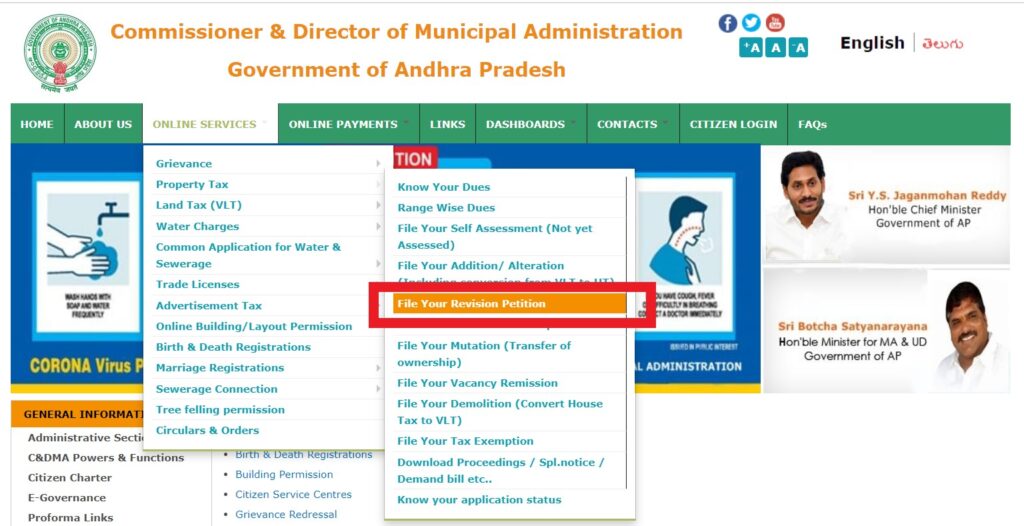

Step 1: Go to the official website of the CDMA, Andhra Pradesh. Click on the Online Services tab available on the homepage of the web portal.

Step 2: On the drop-down menu, click on the option of Property Tax. On the open side list, you will see an option of ‘File your Revision Petition‘.

Step 3: Clicking on the option, a new page will open to file a revision petition. On the open page, select your district, municipality and click on the Submit button.

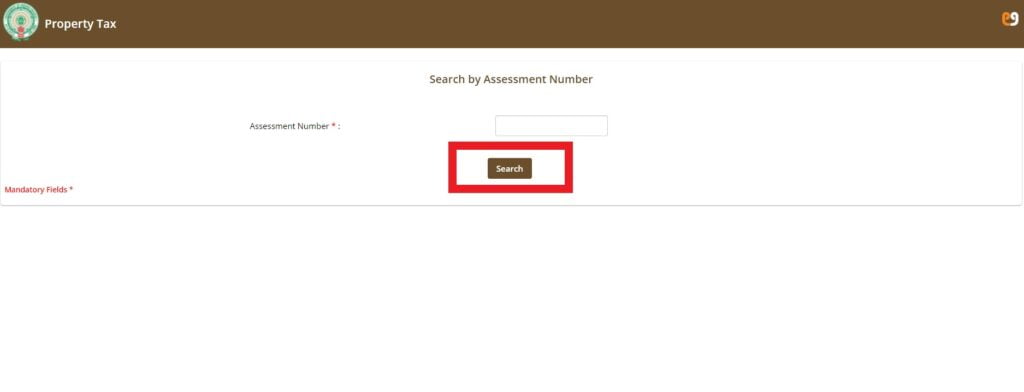

Step 4: Upon submission, a new page will open where you need to Search by the Assessment Number. Enter your Assessment number and click on the Search button.

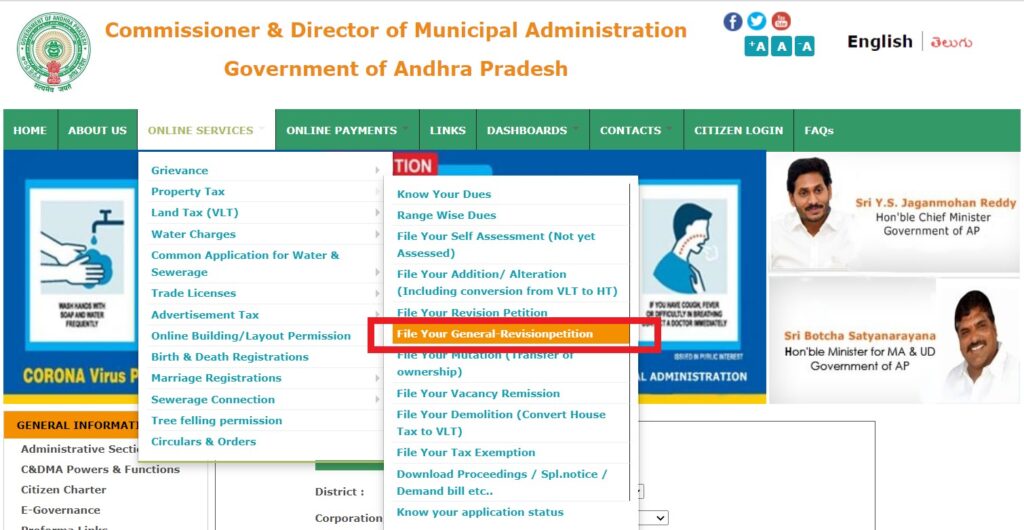

Filing a General Revision Petition

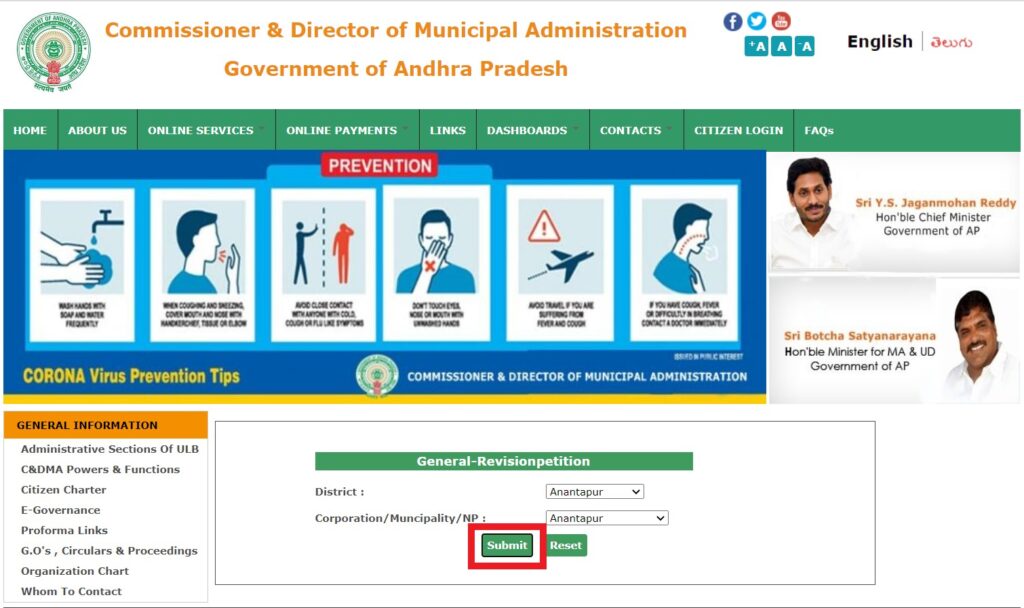

To file a general Revision Petition under the portal, the citizens of the state can follow these steps:

- On the Homepage of the official Portal, click on the Property Tax option available under the Online Services tab.

- Clicking on the option, select ‘File your General Revision Petition‘.

- A new page will open where you need to choose your district, Nagar Palika/ Municipality. After that, click on the Submit button.

- On the next directed page, search by entering your Assessment Number. Click on Search and continue.

AP Property Tax File Mutation

Filing mutation for any type of property is an essential step to change the ownership of that particular estate/ property. Thus the revenue records are also changed in the municipality covering that particular area under estate/ property. To change the ownership, follow these steps:

Step 1: Visit the official website of the authority. Click on the option of property tax under the option of Online Services.

Step 2: On the open drop-down list of options, tap on the option of ‘File your Mutation/ Transfer of Ownership‘.

Step 3: Clicking on the option, a new page will open where you have to district, Municipality. After choosing, click on the Submit button.

Step 4: On the newly directed page, search by entering your assessment number.

Andhra Pradesh Sewerage Connection

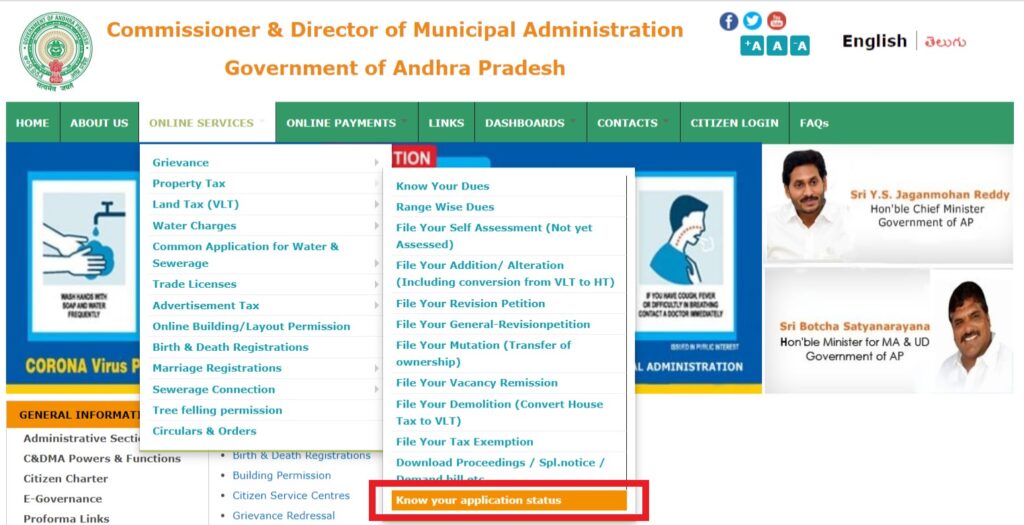

AP Property Tax Application Status

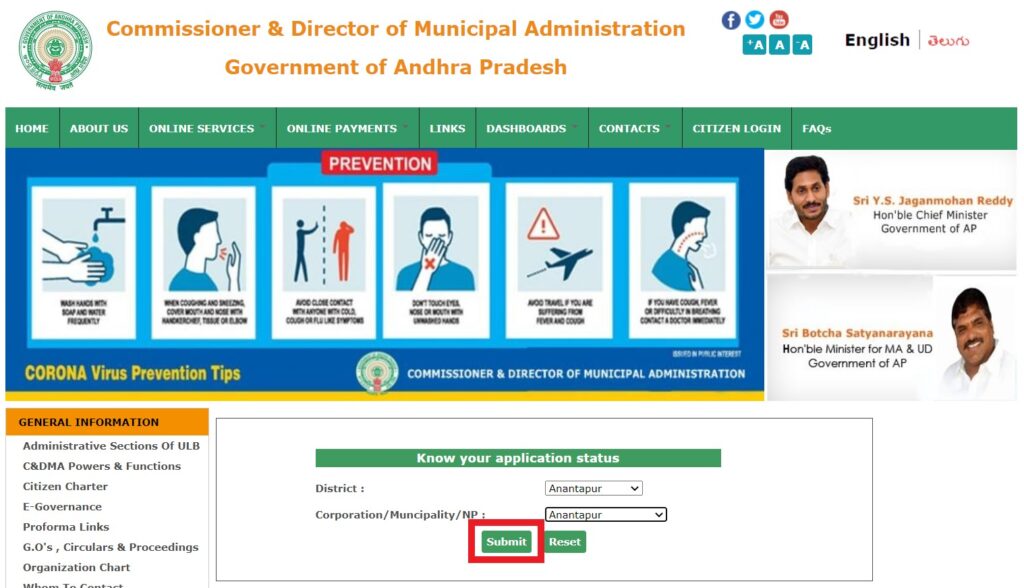

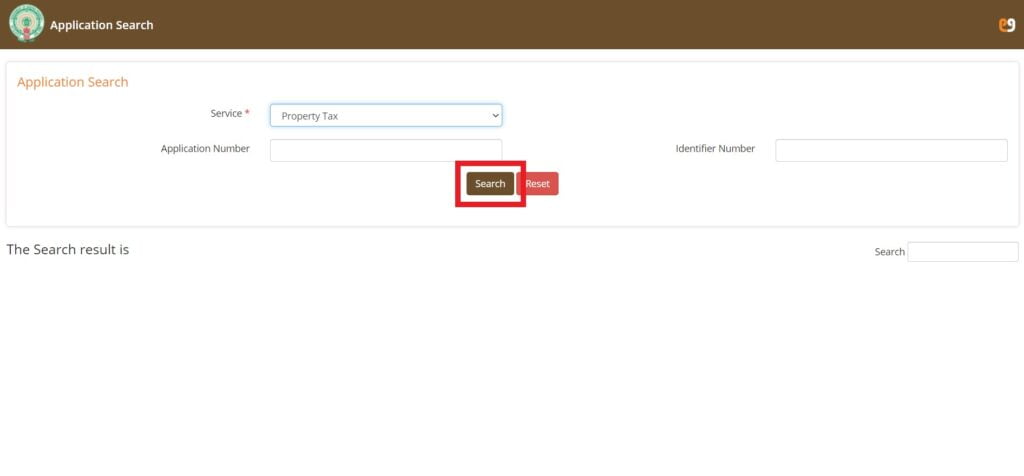

All the users of the CDMA portal, who have applied or accessed any of the online services available on the portal, can also check his/ her application status. To view their application status, users can follow these steps:

- Visit the official Andhra Pradesh CDMA web portal.

- On the homepage, citizens will have to click on the tab of Online Services, available at the top menu bar.

- Clicking on it, a list of services will open up. Click on the option of ‘Property Tax‘.

- An additional side drop-down list will open up. On the open list, click on the ‘Know your Application Status‘.

- A new page will open, where the user will have to choose his district and his municipality/ Corporation. After choosing, users can click on the Submit button.

- On submitting, a new page will open, choose the service type. Enter your application number, Identifier number and click on the Search button.

Other Services under AP Property Tax

In addition to all the services already mentioned, there are other services as well available on the CDMA portal. These are:

- Vacancy Remission Filing

- Filing Demolition (Convert House Tax to VLT)

- Filing Tax Exemption

- Download Proceedings/ Demand bill/ Spl.notice, etc

Puraseva Mobile App

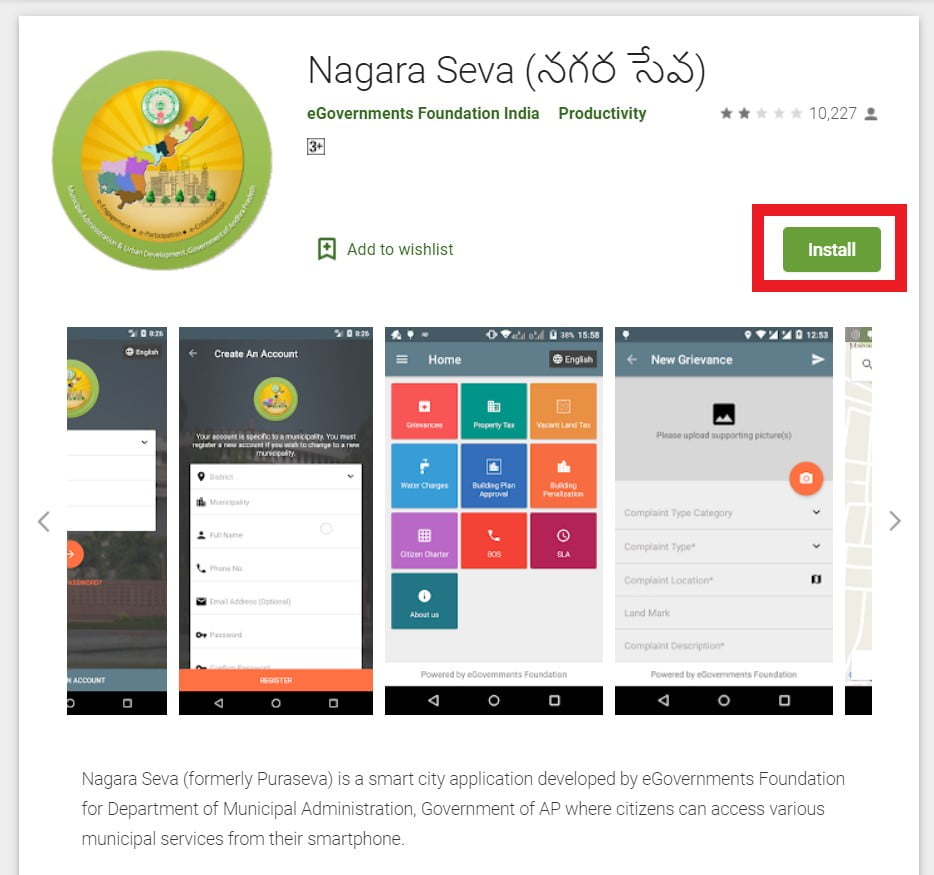

Puraseva App is a Mobile application launched by the Government of Andhra Pradesh. The application is available on the play store and can be downloaded on the mobile phones of the citizens. To download the app, users can follow these steps:

- Tap on Google Playstore on your android device.

- On the search box, type Puraseva app (The app is available on the Playstore as Nagara Seva).

- Click on the Install button of the app which is similar to the one shown below.

The application contains about eight sub-applications for different municipality services. These are:

- Building Plan Approval

- Building Penalization Scheme

- Citizen Charter

- Water Charges

- Property Tax

- Vacant Land Tax

- SOS

- Grievances

Important Links

| Official Website | Click Here |

| Pay AP Property Tax | Pay Here |

| Application Status | Check Here |

| Complaint/ Grievance registration | Register Here |

| Citizen sign up | Click Here |

| PuraSeva App User Manual | Get Here |

Frequently Asked Questions

What is a Property Tax?

It is the type of tax levied on the ownership of any type of property. This tax is payable to the municipal authorities of any area functioning under the state government.

What is the basis of calculating the AP Property Tax?

The taxation value of any property is based on various factors, such as property value, ongoing rates, type of infrastructure, its usage, location and base value.

Where can we file for revision of the Andhra Pradesh Property Tax?

Citizens of the state can very easily file the revision petition on the official portal of the Commissioner and Directorate of Municipal Administration (Andhra Pradesh).

Is Dakhil Kharij and Property Mutation the same?

Yes, both of the terms refer to the change in ownership of an estate/ property.

How to change owner for Property Tax Records?

Citizens of the state can easily do so through the CDMA portal, Andhra Pradesh. Users need to File Mutation through the portal to change ownership. The complete process is present in this article.

Who has to pay the AP Property Tax?

Anyone who owns any type of property under the state is liable to pay the Property tax.

How can I pay my AP Property Tax Online?

Citizens of the state can pay their Property Tax Online through the Official portal of the Municipal Administration. Citizens can proceed further as per the processes mentioned in this article.

Is a tenant liable to pay the Property Tax?

No. A tenant is not liable to pay the Property tax. Such tax is only paid by the owner of the property.

Who can file for revision of taxes?

Revision of taxes can only be filed by the accessee for each year.

If you find this article helpful, you can comment your queries/ feedback in the comment section below.