Andhra Pradesh Land tax is a charge or fee that the landowner has to pay. If you are planning to buy a plot/land, then it is crucial to give sufficient recognition to further expenses. These charges include land registration fees and stamp duty. Many people also refer to land tax as property tax, which is paid for having immovable infrastructure. Whereas, there is no tax for owning vacant land. Under the different states, the owner of a property has to submit the tax annually or bi-annually.

Calculation of land/ property tax in Andhra Pradesh is based on ARV (Annual Rental Value). For every property limit in an urban area, municipal corporation fixes the tax. Get more details about AP land tax, such as know your dues, tax exemption, self-assessment etc by examining this post.

Table of Contents

What is AP Land Tax?

Land/ Property tax is the foremost source of income in Andhra Pradesh municipal department. AP municipal depart implements different methods to reach out the annual value of real estate asset. These assets comprise office buildings, residential homes or rented to 3rd parties, etc. And depending on that measure, the tax rate is imposed.

As we stated above that in Andhra Pradesh, people having property have to pay the tax once a year. The total tax collected from everyone is used by officials for enhancing the infrastructure of the region. Moreover, govt of AP also maintain all the power and water supply of the state. Every state land tax is different from one another. People can pay the land/ property tax online form the official portal of AP municipal department.

Andhra Pradesh Property Types

In AP, there are four main categories of property in Andhra Pradesh state. A brief description of these property types is provided below.

- A vacant land piece that is a quite basic form of property.

- A land in which people have made the improvements like manmade infrastructure i.e. godowns, rental buildings.

- Personal property means that movable gadgets like a car, buses, cranes, truck, etc.

- Lastly, all the tangible things or property.

Aim of AP Land Taxation

The key objective of taxation in Andhra Pradesh is to uplift the revenue and meet spacious public expenses. Taxation finance is mostly for governmental activities to develop the state. Furthermore, the implementation of taxation has few non-revenue goals too. These aims are – price stability, complete employment, development economy of the state, cyclical fluctuations control, and so on.

Eligibility Criteria for Paying Tax in AP

Applicants having empty land need not pay the land tax. However, this statement will not apply to vacant houses or building. AP land tax will be paid by people owning any unmovable infrastructure on a yearly basis.

Important Points of AP Land Tax

| Category of Post | AP Govt Scheme |

| Name of Tax | Andhra Pradesh Land Tax |

| Name of State | Andhra Pradesh |

| Name of Higher Officials | Government of AP |

| Concerning Department | Commissioner & Director of Municipal Administration Government of AP |

| Tax Payees | AP residents owning any type of property in the state |

| Payment of AP Land Tax | Online Mode |

| Benefit of paying tax Online | This process will save the time of civilians |

| Official Portal Link | cdma.ap.gov.in |

Benefits AP Land Tax Online Payment

- Submitting income tax online offers applicants, the flexibility of paying the AP land tax from anywhere at anytime.

- Through the online mode of tax payment, no interest or punishments will be applied if you pay tax at the end minute.

- After paying AP land tax, candidates will receive the acknowledgment receipt instantly.

- Complete information of your is secure and private while paying the tax online.

- After giving the Andhra Pradesh income tax, one can keep an eye on the payment status or other important process.

- In case any tax payee lost their receipt, then they can receive it through online mode.

AP Sewerage Connection New Connection

AP Land/ Property Tax Assessment

When citizen pay the land/ property tax for the first time, then record of assessment book is made. The assessment book consists of few details that are mentioned in the table presented here.

| Owner Name | Locality | Construction Type |

| Revision Petition Date Receipt | Serial Number | Hearing Date |

| Area in square meters | Six months Property Tax | Property Rental Value (Monthly Basis) |

| Commissioner Initials | Zone Number | Commission order complete info |

| Tax of property after review petition disposal | Commissioner Order | Door Number |

| Special notice of service date | Periodically rental value of square per meter of area according to the form | Nature of usage |

Procedure to Pay AP Property Tax Online

We understand that offline tax paying is quite time consuming for working people. So, these candidates can now pay the land tax in Andhra Pradesh through online medium. For paying tax of property online in AP, citizens have to execute the method written over here.

- First of all, people have to open the official website i.e. cdma.ap.gov.in.

- The home screen of the website will load on your device.

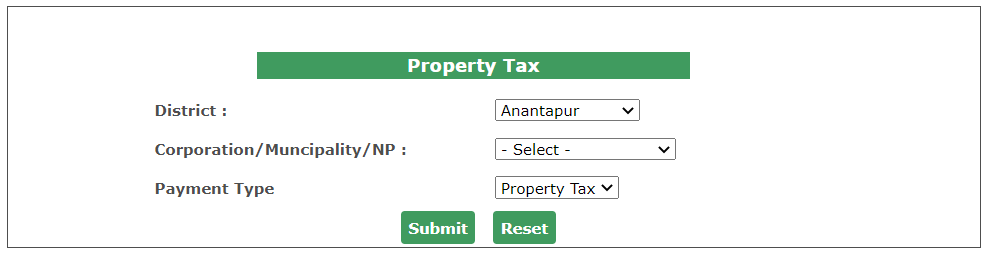

- Click the “Online Payments” option, and a drop-down will present on the screen.

- Then, choose the “Property Tax” link.

- Enter the details asked in the form and hit the submit tab.

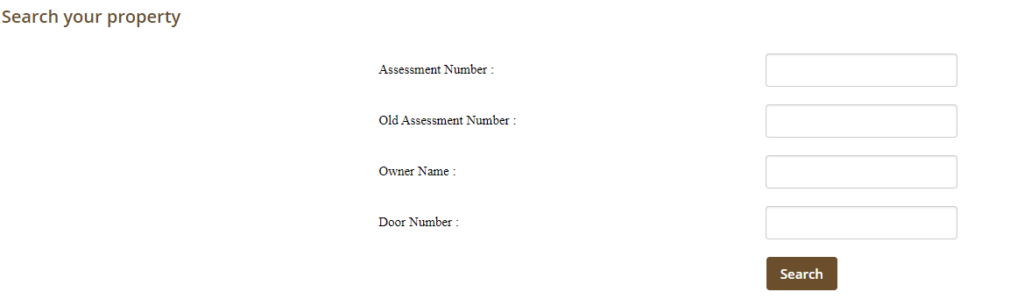

- Then, proffer data like assessment number, old assessment number, owner name and the door no.

- Information about your property will be displayed, then click the button “Pay Tax”.

- Pay the appropriate amount and an acknowledgment receipt will be prepared.

- Download the receipt for another usage and keep it safe.

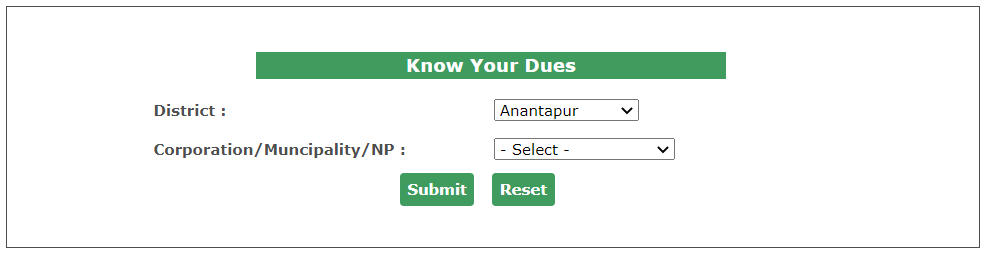

How to Know Andhra Pradesh Land Tax Dues?

If you are searching the procedure of knowing your dues from online mode, then must read the easy steps explained in the up next portion. By implementing mentioned procedure, citizens will easily know their dues.

- Initially, civilian of AP are required to visit the official website of the Municipal Administration Department, Andhra Pradesh.

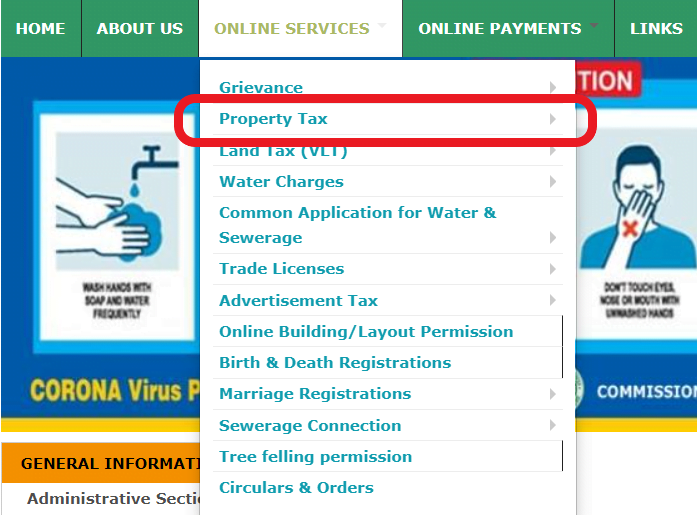

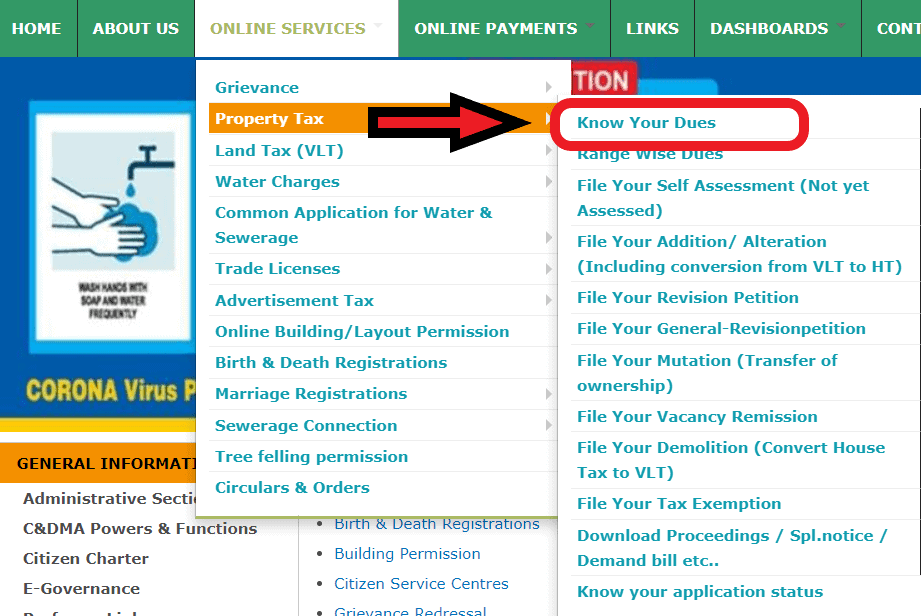

- Then, click on the “Online Services” option from the menu bar and choose the “Property Tax” link.

- A sub drop-down box will appear from which applicants have to select the link named “Know Your Dues”.

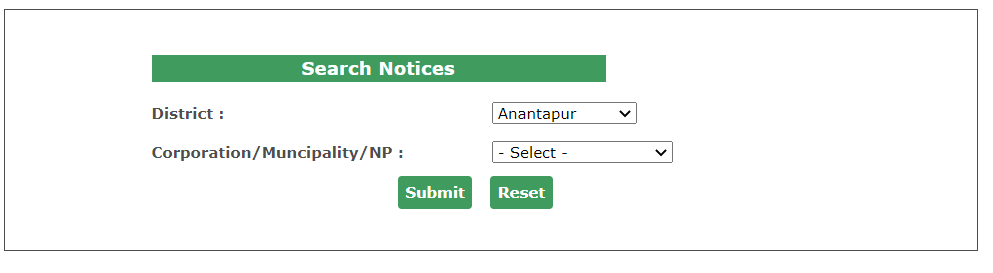

- In the next step, choose the appropriate district and municipality/ corporation.

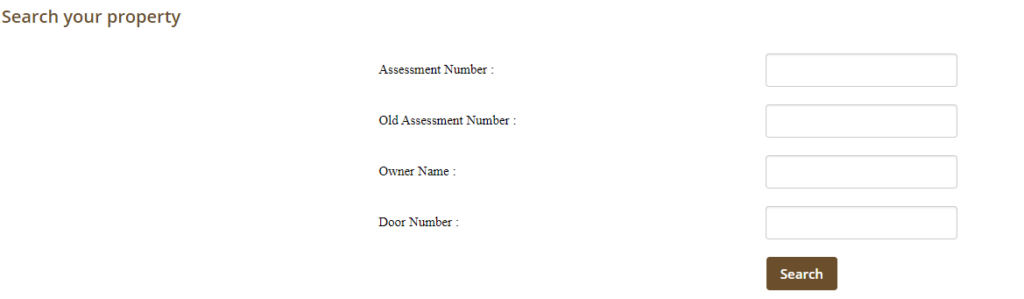

- After that, inert your assessment number, owner name, old assessment number and door number.

- Tap the “Search” button, and your due will flash on the screen.

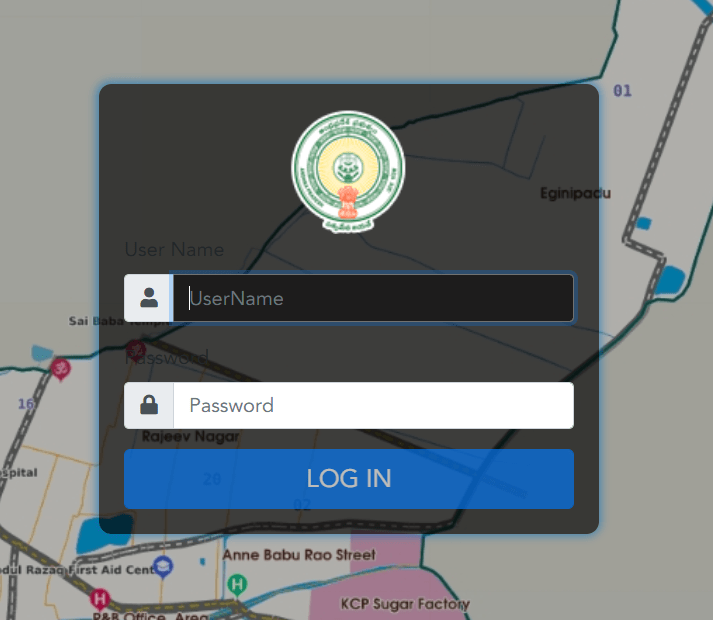

Check AP Range-wise Dues

- Go to the official web portal of Commissioner & Director of Municipal Administration Govt. of AP.

- Next, choose the link of “Range wise Dues” given under the “Property Tax” tab.

- Then, enter your username and password.

- Choose the range of area on the map and check due for it.

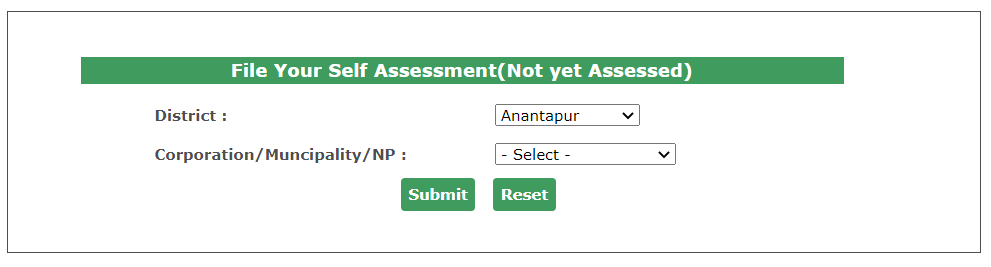

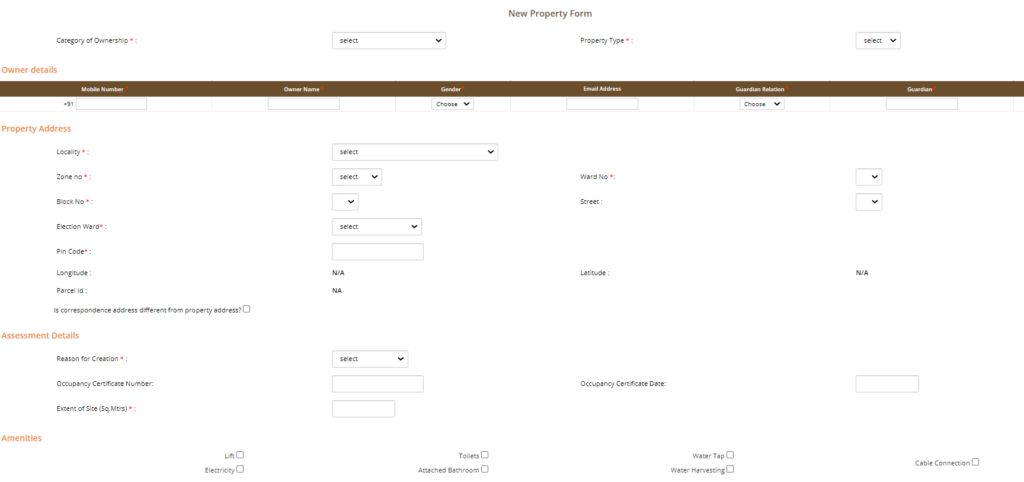

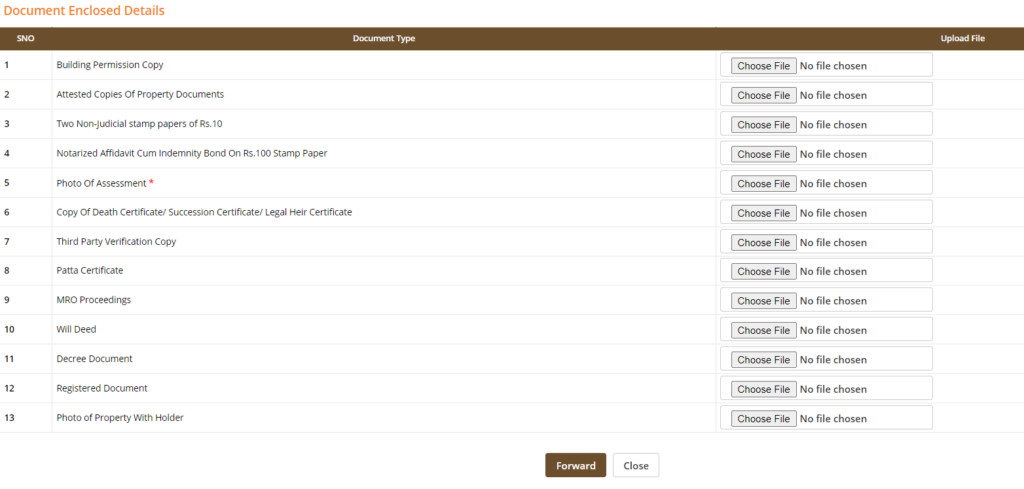

Process to File Self Assessment

- To do so, candidates are needed to open the link of the official website on any safe browser.

- Choose the “Online Services” option from the menu of the landing page.

- Click the link of the “File Your Self Assessment” link mention under the “Property Tax” menu item.

- Next, select your district and corporation details.

- A property form will flash on your screen.

- Insert all the required data such as owner info, property info, assessment data, construction type, floor info, etc.

- Upload the scanned copy of all the required certificates.

- Hit the forward option and complete the payment process.

- Download the acknowledgement receipt for the future.

Some Important Online AP Land Tax Services @ cdma.ap.gov.in

There are several services comes under AP land tax whose necessary steps are illustrated below.

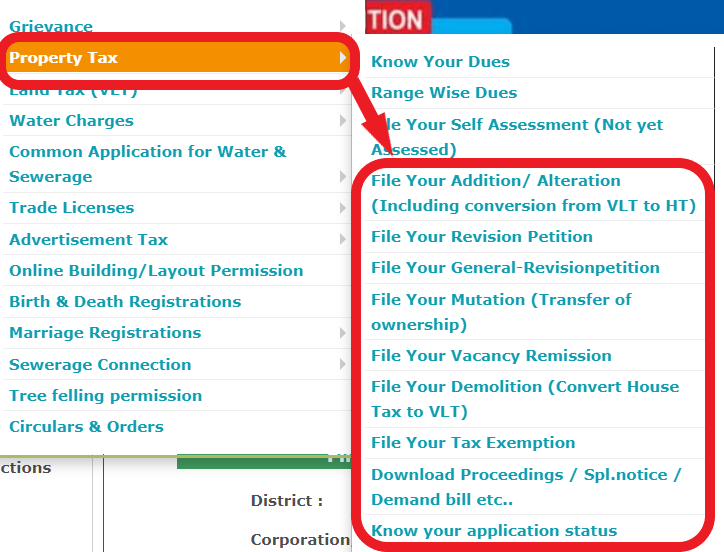

File Your Addition/ Alteration

- First of all, go to the official website i.e. cdma.ap.gov.in.

- Click on “Online Services” and choose the “File Your Addition/ Alteration” link.

- Then, select the respective district and municipality and submit it.

- In a new tab, provide your “Assessment Number” and search the info.

- Finally, alter or add details in the property data.

File Your Revision Petition

- In the beginning, open the official link of AP municipal.

- Next, hit the “Online Services” choice from menu.

- After that, search for the “File Your Revision Petition” option under “Property tax”.

- Fill your district and corporation/ municipality info on the next page.

- After submitting the data, insert your assessment number and search the property info.

- Finally, you can easily file the revision petition for the property.

Filing Your General Revision Petition

- In the starting step, open the municipal corporation of AP.

- Choose the “Property tax” link from the “Online Services” option.

- Then, hit the link labelled “File Your General Revision Petition”.

- Choose the respective district and municipal corporation.

- Enter the assessment number and file the general revision petition.

File Your Mutation

- Those candidates who want to transfer their ownership have to visit the official site.

- Wait for a second to load the homepage on the screen.

- Click the “Online Services” option, then select the “Property Tax” link.

- Now, tap the link labelled “File Your Mutation”.

- Choose the municipality and district information and submit the details.

- Provide your assessment number and transfer the ownership.

File Your Vacancy Remission

- Citizens have to go to the Director and Commissioner Municipal Dept official website of AP Land Tax.

- Hit the link of the “Property Tax” given under the “Online Services” drop-down box.

- Choose the “File Your Vacancy Remission” link.

- Enter the details asked on the screen and tap the “Submit” button.

- Next, input your “Assessment Number” and complete the vacancy remission procedure.

File Your Demolition

- Firstly, interested civilians have to visit the official web portal AP Land Tax.

- Landing page will present on your screen.

- Click the “Online Services” tab, and choose the “Property Tax” option.

- Another drop-down box will appear on the screen in which candidates have to select the “File Your Demolition” link.

- Then, insert your municipal/ corporation and district information.

- Submit the data entered by you.

- Give your assessment number and search property details.

- Lastly, you can convert your house tax into vacant land tax (VLT)

File Your AP Land Tax Exemption

- If you are looking for tax exemption, then open the AP Land Tax official website of the Municipal Corporation of Andhra Pradesh.

- Select the option of “File Your Tax Exemption” given under the “Property Tax” tab.

- A new page will open on your screen where candidates have to select the district and municipality.

- Then, insert your “Assessment Number” and search the details.

- Complete the process of tax exemption.

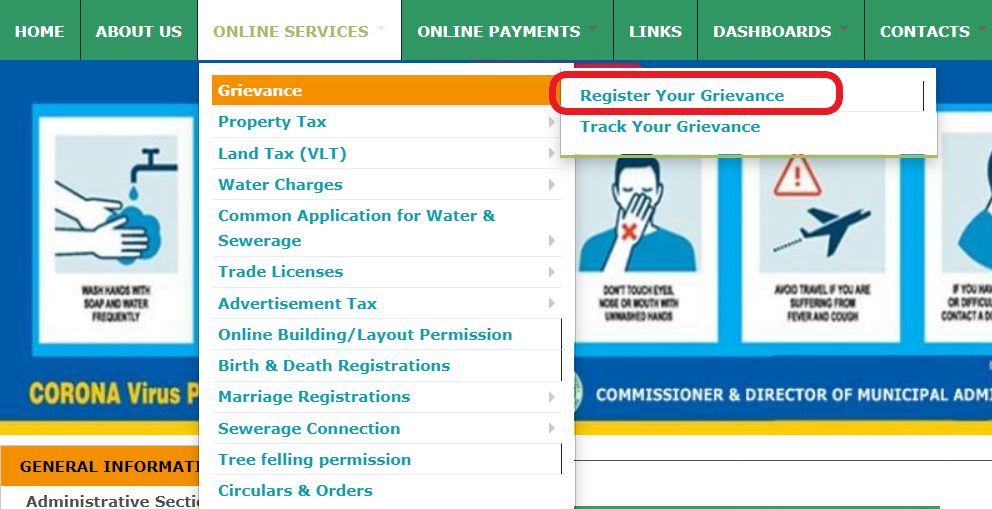

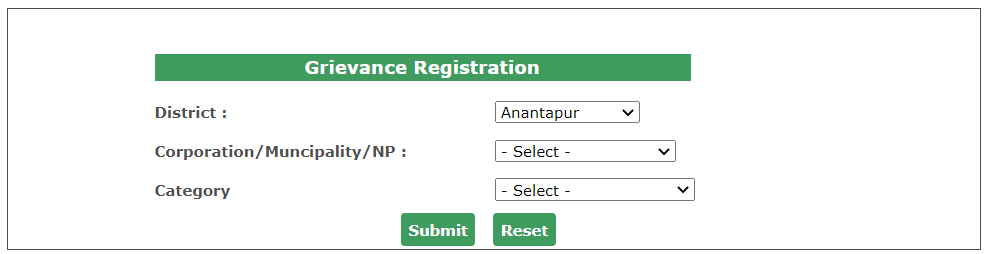

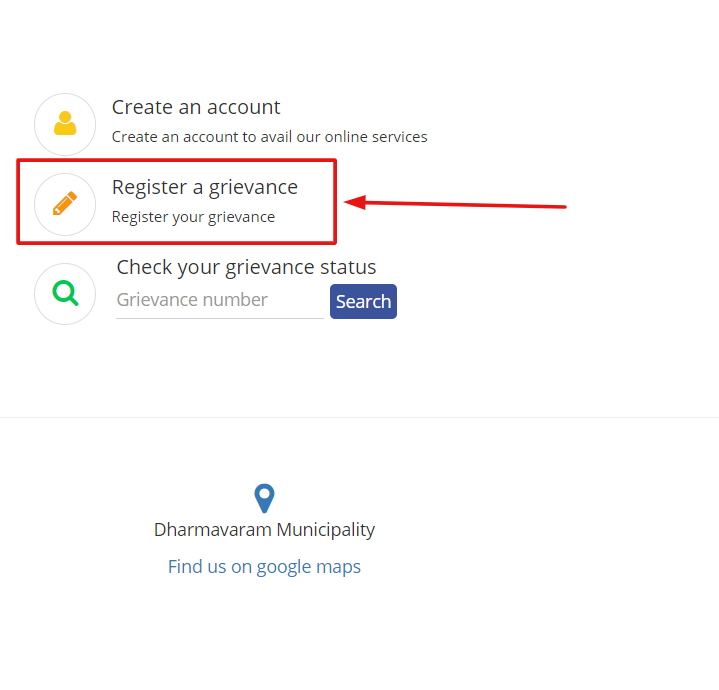

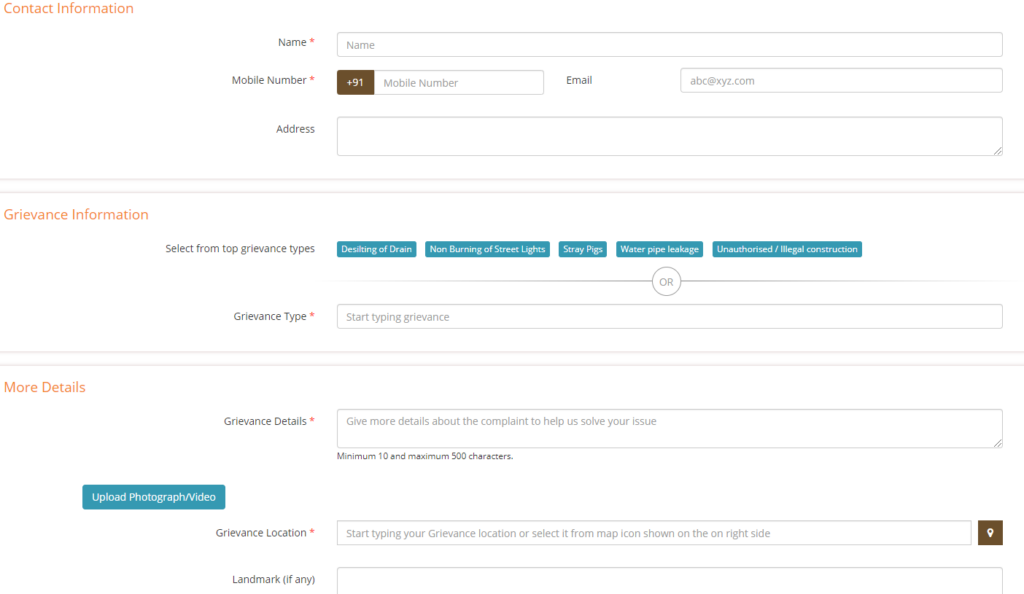

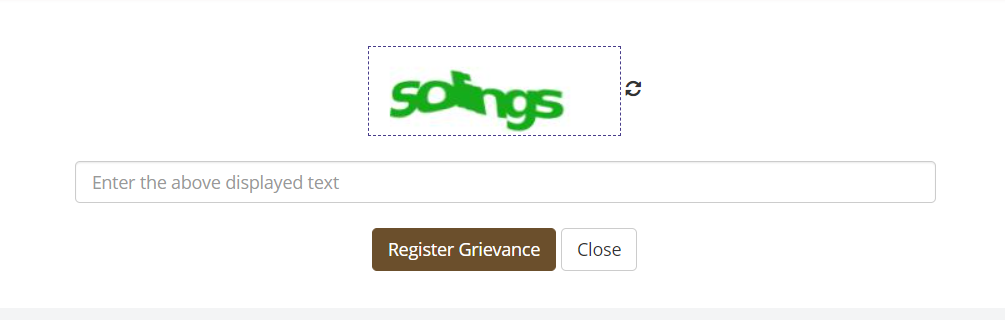

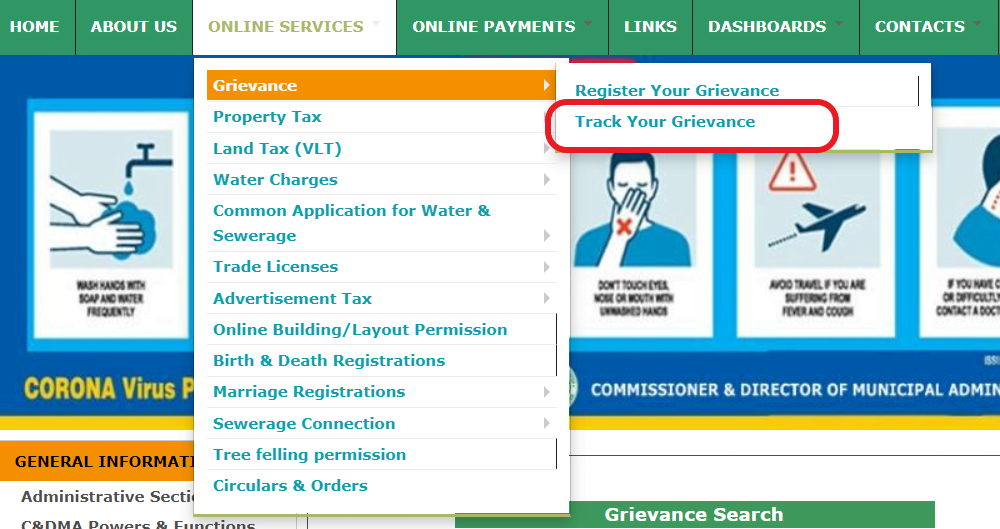

How to file Register Grievance via cdma.ap.gov.in

In case any citizen has an issue or wishes to file a complaint, then officials have made a separate section for it. Here, we have described the procedure of filing a grievance, which candidates have to implement as it is.

- Initially, applicants have to go to the Municipality portal of Andhra Pradesh.

- From the home screen, choose the “Grievance” option.

- Next, click the link named “Register Your Grievance”.

- On the next page, give your details such as “District, Corporation, and Category”.

- A new tab will flash on your screen, and select the link “Register a Grievance”.

- The grievance form will be presented in a new tab. Insert your contact info, grievance info, and other details.

- Candidates can also upload the photograph or video of the grievance.

- Finally, register your grievance by submitting it.

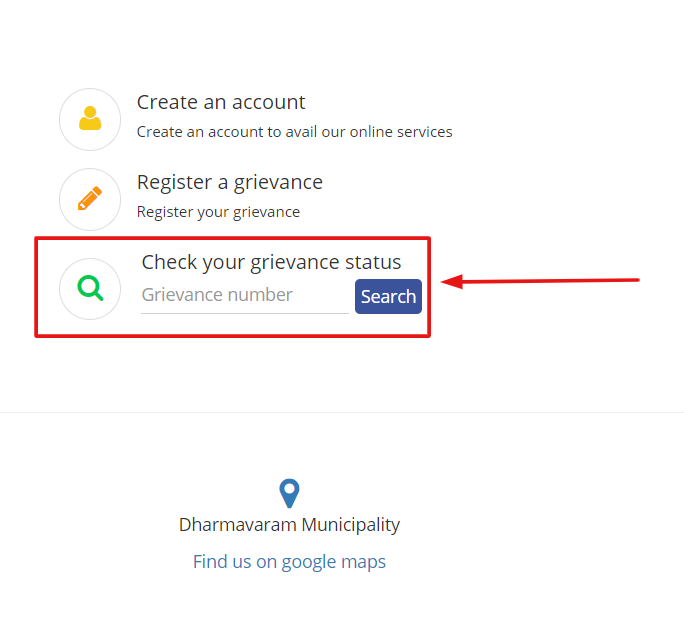

Procedure of Tracking Grievance Application in AP Land Tax

All those applicants who have submitted their grievance can also its status online though the CDMA official website. Go through with the steps explained below of this portion.

- In order to view the status of the grievance, aspirants must open the official site.

- Then, click the “Track Your Grievance” link from the “Grievance” option.

- Enter your corporation and district information.

- Now, input your “Grievance Number” and tap the “Search” button.

- In some moments, your grievance information will be presented on your device.

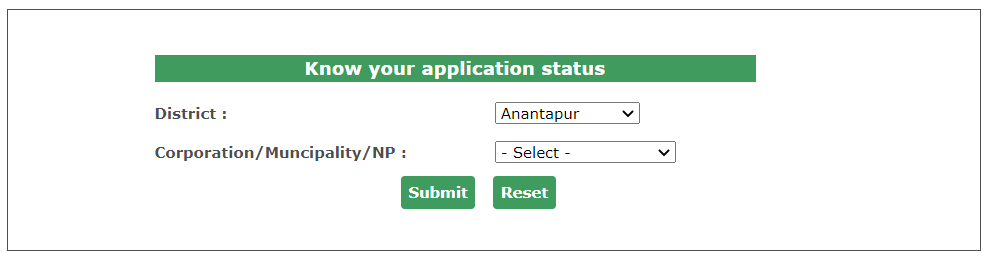

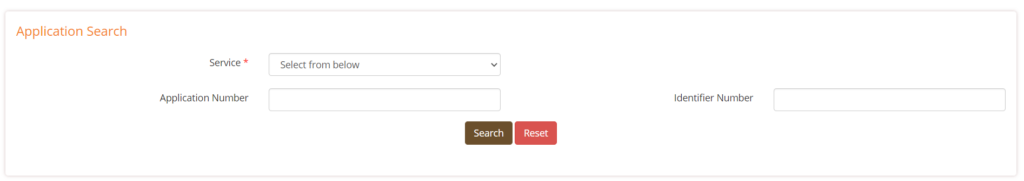

Procedure to Know Your AP Land Tax Application Status

After applying one of the services written above, keen aspirants can also check their application status by following the procedure described in the up next section of this post.

- In the first step, applicants are requested to visit the official portal that is cdma.ap.gov.in.

- Tap the link of the “Online Services” option from the menu items of the home screen.

- Next, choose the “Know Your Status” link mention under the “Property Tax” drop-down.

- Then, provide info of your district and municipality and submit it.

- A new tab will be displayed, input the data like service, application number and identifier number.

- Hit the “Search” button, and the status of your application will flash on your screen.

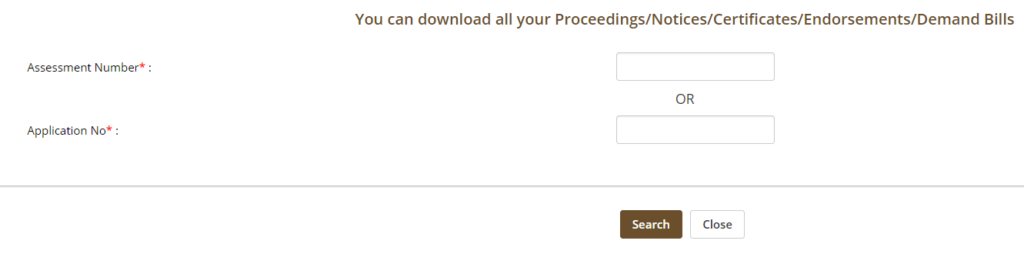

How to Download Proceedings Notices/ Demand Bills

- For downloading notices, you have to type the link of the official website i.e. cdma.ap.gov.in.

- Choose the “Online Services” and a drop-down will appear.

- After that, select the “Download Proceedings Notices/ Spl. Notices/ Demand Bills“ link given under “Property Tax”.

- Now, furnish your district and municipality details.

- In the next tab, write your assessment number and application number and search info.

- A list of all bills and proceedings will flash on your screen.

- Download the bills or notices accordingly.

AP Land Tax Important Links

| Commissioner and Director of Municipal Dept. AP |

| Pay AP Property Tax Online |

| File A Grievance |

| Know Status of Grievance |

AP Land Tax Related FAQ’s

No, all those people having empty land, do not have to pay any type of tax for it.

Citizen of Andhra Pradesh who will not pay the property tax at the prescribed time have to pay the penalty for it.

As we told above, that it is a safe procedure. Yes, by paying tax from the official website of the AP municipal organization, details of applicants will be secured.

Applicants having a complaint can submit it via online method by selecting the grievance option from the home page. Complete process is mentioned above in this passage.

There few aspects on which annual rental cost is calculated that are as follows: Property Age, Zonal Location of Property, Construction Type, Plinth Area, Residential or Non-residential, etc.

Yes, aspirants looking to exemption in tax can file the application from AP Municipal dept. official website.

The government of different regions have developed portals for paying tax online and this site link is only for residents of AP state.