The Government of India introduced the Sukanya Samriddhi Yojana for all the female citizens of India. It is a small saving scheme which comes under the Beti Bachao Beti Padhao Campaign. The scheme is launched only for girls and aims to support them with the coverage of education and marriage expenses. Under the scheme, the guardians or parents of the children will have to pay a certain amount yearly, and a good rate of interest will be applied to it. Now, one question which comes to every person’s mind is how to know what amount will provide the best outcomes. In this situation, the Sukanya Samriddhi Yojana Calculator will be helping you.

Table of Contents

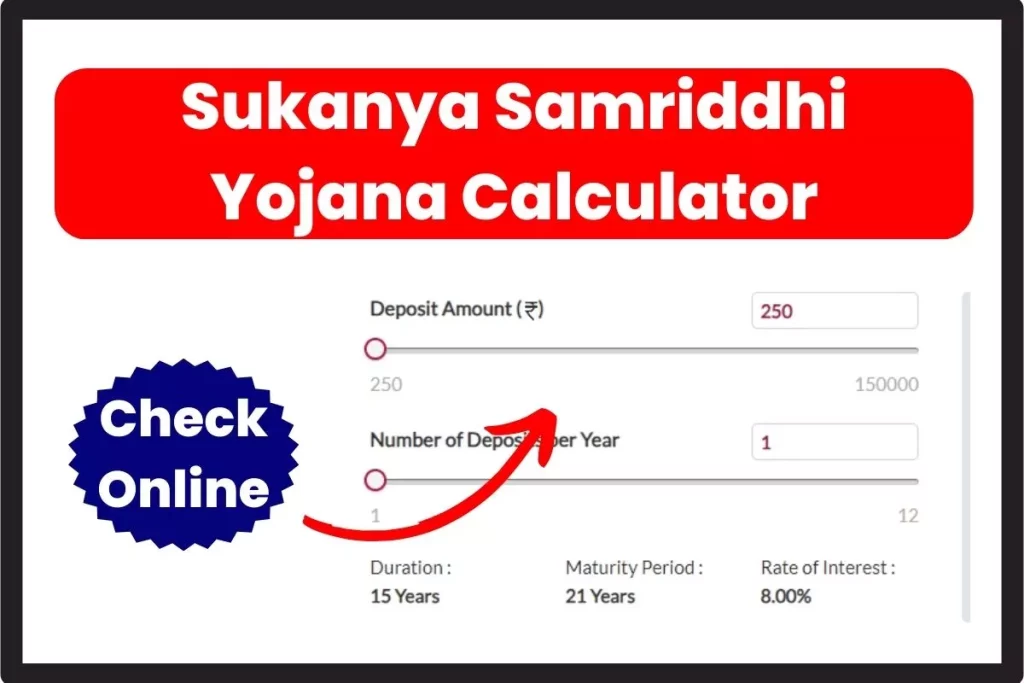

Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Yojana will provide you with the maturity amount which you will get by making a certain investment along with the maturity year. To get an accurate outcome, one must enter the data in the Sukanya Samriddhi Yojana Calculator correctly. Get more details regarding सेवा समृद्धि योजना Calculator in the following article.

How to use a Sukanya Samriddhi Yojana calculator?

The following section is going to clear all doubts one has regarding the usability of the calculator. Follow the guidelines mentioned here to learn how to use this calculator:

One will have to provide the information regarding the following particulars:

- Investment Per Year: Under this field, you will have to provide the amount which the depositor is willing to contribute each year for the benefit of his/ her child.

- Age of the Girl: Next, you need to enter the current age of the girl for whom you are opening the SSY account.

- Commencement Year: In this field, depositors need to enter the year from which they will start investing the amount.

After providing the above-mentioned details which is probably going to take a few seconds, one will get the following data:

- Maturity Year: Under this section, the calculator will show the year in which the scheme will be maturized. Please note that the calculator calculates the years by considering the official details i.e., 21 years is needed for the scheme to reach the maturity year.

- Maturity Amount: Under this section, the total value will be displayed which one will get after the completion of the 21 years.

Who can use the Sukanya Samriddhi Yojana Calculator?

First of all, it is important to check whether the person is eligible for the scheme or not before using the Sukanya Samriddhi Yojana Calculator. The SSY account can be created by the legal guardian of the beneficiaries. There are the conditions which must be fulfilled to become eligible for the scheme:

- Only a girl child can apply for the scheme.

- Beneficiaries must be permanent citizens of India.

- The age of the girl child should not be more than 10 years old.

- A family can open a total of two accounts with two girls.

Along with this, the legal guardians will also have to attest some documents to start the deposit process for the scheme. The following is the list of requisite documents:

| Birth certificate of the girl child |

| Under single birth order, in case of birth of multiple children medical certificate |

| Valid address proof and identification document of the depositor |

| Duly filled account opening form with all relevant details of the girl child and the account holder |

Readers who fulfil all the conditions mentioned in the particular paragraph along with the supporting documents are eligible for the scheme mentioned above and can use the calculator available on this page.

How does the Sukanya Samriddhi Yojana Calculator Work?

In the following paragraph, we are going learn how exactly the calculator works and provide us with the correct data. If you are interested in learning about it then scroll down the page and read it:

First of all, it is important to note that the tenure for the amount to be matured is 21 years. Individuals who have applied for the scheme can make the least contribution once a year to keep the scheme alive till it completes a total of fourteen years.

Individuals will also be allowed to not make any kind of contribution to the SSY account between a year or the 21st year if they would like to. However, investments made earlier in the respective account will continue to earn at the specified interest rate. Hence, the officials will calculate the final amount based on the net contribution made by the legal guardian along with the earned interest.

Given below is the formula used by the Sukanya Samriddhi Yojana Calculator for generating the results:

A = P (1 + r/n) ^ nt

where,

A shows Compound Interest, P shows the Principal Amount, r shows the Rate of Interest, n shows the number of times interest compounds in a year and t shows the number of years.

For example, a family invested in the Sukanya Samriddhi Yojana when their daughter was born. Suppose they make a yearly contribution of Rs. 15,000 for the upcoming fifteen years. No withdrawal is made during the mentioned time. Considering the current interest rate i.e., 7.6%, a person would earn Rs. 14,47.689 after the completion of 21 years. The total investment value at the maturity date will be Rs, 21,97,690/-

Advantages of using the Sukanya Samriddhi Scheme Calculator

Now, we will mention some of the key advantages which one gets while using the calculator available on our page. Let’s take a look at the offered advantages:

- We have provided the Sukanya Samriddhi Yojana Calculator, which can be used free of cost, and it provides the result error-free for multiple data.

- The calculator is advanced and hence can produce the outcome within a few seconds if good quality internet is being used.

- We have offered the calculator on the website. Thus, one will not have to download any kind of app for the accessibility of the SSY Calculator.

- Individuals will not be asked to sign up or sign in to the website to use the calculator. It will also not ask for any personal information. You can simply enter the data and get the result.

- We have not put any limit on the number of times one can use the calculator.

- The calculation made by this calculator is based on the latest SSY interest rates for more accuracy. So, individuals are stress-free from entering the interest rate.

- The available SSY calculator is up to date. In case, any changes are made in the Sukanya Samriddhi Yojana which can affect the result provided by the calculator then the updates will also be made to the provided calculator.

- You can use the SSY calculator on any device, and it will provide the same quality results.

The SSY Calculator helps calculate the amount which one can contribute to the account each year comfortably. Please note that opening an SSY account for your girl child is one step towards securing the future of your child in a world where expenses such as education are getting higher day by day.

How can सेवा समृद्धि योजना calculator help you?

The parents of a girl child mostly look for investments for their child which can help her in the future to cover the expenses that usually occur during education and marriage.

There are hundreds of investment venues available for parents. However, Sukanya Samriddhi Yojana has become one of the most known schemes that provide high-interest rates along with the benefits of the tax. It is important to note by individuals that one can claim the exemption on tax up to Rs. 1.5 lakh from the contributed amount to the respective SSY account under Section 80C of the Income Tax Act.

Additionally, the amount generated from the amount invested by an individual is also expected from all kinds of tax. The benefits of tax have been extended till the maturity amount as well. Considering all of these benefits, many parents of a girl child usually prefer the Sukanya Samriddhi Scheme for investment. Now, one needs calculators which can help them in calculating the amount they will receive during maturity. The manual calculation is not always correct and takes a lot of time. Therefore, one should use the Sukanya Samriddhi Yojana Calculator for error-free calculations.

As per the maturity amount, users will be able to make certain changes to the regular contribution which will help them in reaching up to the desired corpus. The calculator is available free of cost and produces error-free data.

Sukanya Samriddhi Yojana comes under the long-term investment scheme which is only beneficial if you want the amount after quite some years. The scheme also provides a high rate of interest. One just has to make a small contribution every year to keep the SSY account active.

Therefore, one can do the overall assessment of their investment and returns to get the best benefits by using the calculator provided on this page.

Limitations of SSY Calculator

Every tool has its advantages as well as disadvantages. In the following section, we are going to elaborate on the limitations of the SSY Calculator:

- In case the data is not entered correctly, the value provided by the calculator can be incorrect.

- It must be noted that the concerned authority has put a cap of Rs. 1.5 lakhs. However, the calculator has not set a limit on the annual investment. So, if one enters the investment amount of higher than Rs. 1.5 laks, then the calculator will still calculate its outcome.

- In case the interest rate has changed recently and the calculator is not yet updated, then the outcome released by the calculator will be according to the previous Rate of Interest. The calculator might also ask one to enter the interest amount.

Ammprtization Earned Under thukanya Samriddhi Yojana

| Year | Amount Deposited | Interested Earned | Year End Balance |

| 1 | Rs. 250/- | Rs. 20/- | Rs. 270/- |

| 2 | Rs. 250/- | Rs. 42/- | Rs. 562/- |

| 3 | Rs. 250/- | Rs. 65/- | Rs. 877/- |

| 4 | Rs. 250/- | Rs. 90/- | Rs. 1217/- |

| 5 | Rs. 250/- | Rs. 117/- | Rs. 1584/- |

| 6 | Rs. 250/- | Rs. 147/- | Rs. 1981/- |

| 7 | Rs. 250/- | Rs. 178/- | Rs. 2409/- |

| 8 | Rs. 250/- | Rs. 213/- | Rs. 2872/- |

| 9 | Rs. 250/- | Rs. 250/- | Rs. 3372/- |

| 10 | Rs. 250/- | Rs. 290/- | Rs. 3911/- |

| 11 | Rs. 250/- | Rs. 333/- | Rs. 4494/- |

| 12 | Rs. 250/- | Rs. 380/- | Rs. 5124/- |

| 13 | Rs. 250/- | Rs. 430/- | Rs. 5804/- |

| 14 | Rs. 250/- | Rs. 484/- | Rs. 6538/- |

| 15 | Rs. 250/- | Rs. 543/- | Rs. 7331/- |

| 16 | Rs. 0/- | Rs. 586/- | Rs. 7918/- |

| 17 | Rs. 0/- | Rs. 633/- | Rs. 8551/- |

| 18 | Rs. 0/- | Rs. 684/- | Rs. 9235/- |

| 19 | Rs. 0/- | Rs. 739/- | Rs. 9974/- |

| 20 | Rs. 0/- | Rs. 798/- | Rs. 10772/- |

| 21 | Rs. 0/- | Rs. 862/- | Rs. 11633/- |

Frequently Asked Questions

What is Sukanya Samriddhi Yojana?

The government of Indian launched the Sukanya Samriddhi scheme in 2015. It is a small saving scheme which comes under the “Beti Bachao Beti Padhao Campaign”. Under this scheme, the SSY account of a girl child is opened at the post office and partnered with private or public banks. The parents make small contributions every year. After the completion of the maturity, the girl child receives the amount along with interest earned on it.

What is the use of the SSY Calculator?

SSY calculator helps users calculate the amount they will receive once the amount reaches its maturity. It also provides the year on which the amount will reach its maturity. It is time-saving and trustworthy.

What is the difference between Sukanya Samriddhi Yojana and Provident Fund?

Both the Provident Fund as well as Sukanya Samriddhi Scheme come under the long-term investment offered by the government. In terms of long-term plans, regulated plans, interest rates and others, both of them are similar. However, the goal of the investment is not similar. Provident Fund investment is made any a single person. Whereas the investment made in SSY is made by the guardian or parents.

Who Can Use the SSY Calculator?

The calculators can be used by anyone to calculate the maturity amount. Usually, parents and guardians of a girl child use this tool to choose the investment which can create the best outcome for their child.