This scheme provides loans to non-farming income-generating businesses in Manufacturing, Trading and Services. PM Mudra Yojana is launched by the honourable Prime Minister on April 8th 2015. The loan provided is about 10 lakh, known as MUDRA loan. The loan is provided to individuals through Commercial banks, Small finance banks, Cooperative Banks etc. The person who wants to take the loan can either go to the authorities or can apply online through the PM Mudra Yojana portal.

Table of Contents

PM Mudra Yojana

PM MUDRA Yojana, also known as Pradhan Mantri Micro Units Development and Refinance Agency Limited (MUDRA) is a Non-Banking Financial Company (NBFC) whose primary purpose is to focus on the development of small business owners in India. This financial unit was majorly set up for the development and refinancing of small businesses in order to generate their income. PM Mudra Yojana is an alliance with the MAKE IN INDIA initiative led by the Government of India whose purpose was to encourage new ideas and develop the foundation of India.

In this article, you will see all the relevant information regarding Mudra Yojana. You can read detailed information on how to apply for a loan? Who is eligible for the loan? How much loan is to be provided? And each bit of detail regarding the PM MUDRA YOJANA. Hence, keep reading to know some interesting things about Mudra Yojana.

PM Mudra Yojana is entrepreneurship is benchmarked on a value basis. The Mudra loan scheme was brought forth by the Finance Minister during FY 2016 Union Budget presentation. The aim with which Mudra was brought forth was to provide enough funds for small businesses in order to generate a sufficient amount of income outlet.

Accordingly, the Department of Financial Services, Ministry of Finance, Govt. of India’s letter No.27/01/2015 -CP/RRB addressed on May 14, 2015, stated in the report that loans will be provided to small businesses will be below Rs.10 lakh. It will be ensured to people through Regional rural banks, State cooperative banks, Public sector banks, and Urban cooperative banks in addition to the banks, NBFCs and MFIs.

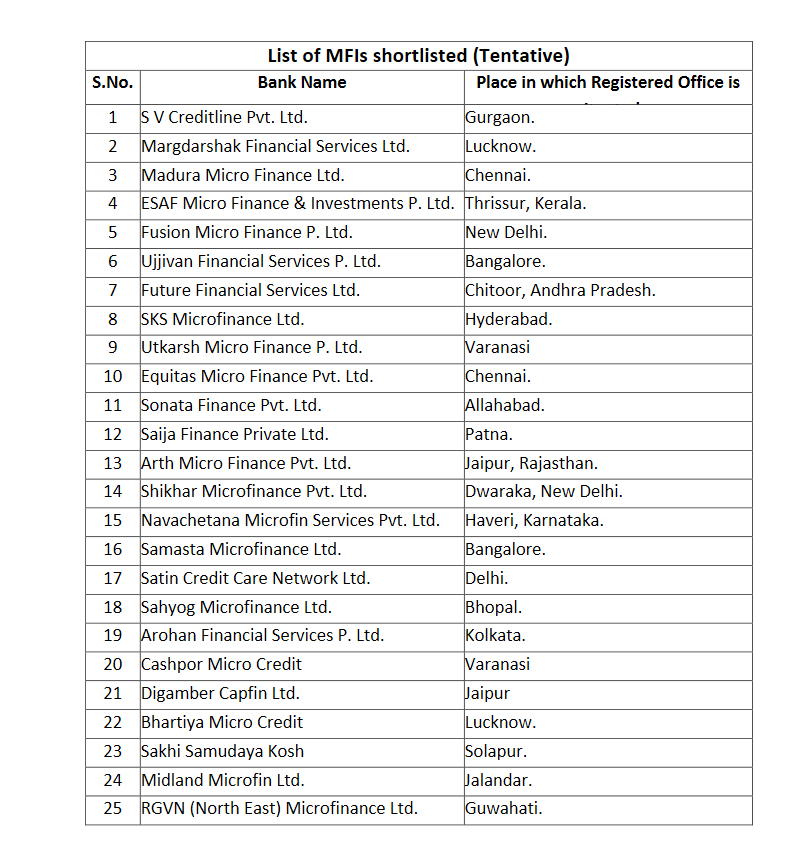

There are about 27 Public Sector Banks, 17 Private Sector Banks, 27 Regional Rural Banks and 25 Micro Finance Institutions under Mudra Yojana. These are enrolled in order to provide help to the borrower.

To begin with, based on eligibility criteria, MUDRA has enrolled 27 Public Sector Banks, 17 Private Sector Banks, 27 Regional Rural Banks and 25 Micro Finance Institutions (MFIs – list as per Annexure I) as partner institutions for channelizing assistance to the ultimate borrower. To get a loan borrower needs to follow the terms and conditions set by the agency. The lending rates may vary according to RBI. Within just 59 minutes you can get a loan.

Key points of PM Mudra Yojana

After being set up by the government of India, Mudra has introduced some new schemes under it. These sub-schemes has been introduced in stating growth, development and funding. The three sub-schemes are – Shishu, Kishore and Tarun.

| Name of scheme | PM Mudra Yojana |

| Launched on | 8th April 2015 |

| Launched by | Hon’ble Prime Minister |

| Name of Scheme | Pradhan Mantri Mudra Yojana |

| MUDRA | Micro Units Development & Refinance Agency |

| Mudra | Refinance Agency |

| Category | Central Government Scheme |

| Subsidy of | Small Industries Development Bank of India Pradhan Mantri Mudra Yoajana |

| Loan offered | Below Rs 10 lakh |

| Borrower category | small/micro business or enterprises |

| Loan provided by | Commercial banks, RRB’s, Funding institution |

| Mudra’s Initial scheme | – Shishu – Kishore – Tarun |

| Processing Fee | Except for the Shishu loan, others need to pay about .2% of the loan amount |

Eligibility of PM Mudra Yojana :

The candidates must full fill all the criteria’s given down below in order to get a loan.

- The age limit is minimum to be 18 years old and maximum to be 65 years old.

- The candidate should be a business owner.

- Small producer

- The work is in regard to Agricultural activity.

- And start up candidates

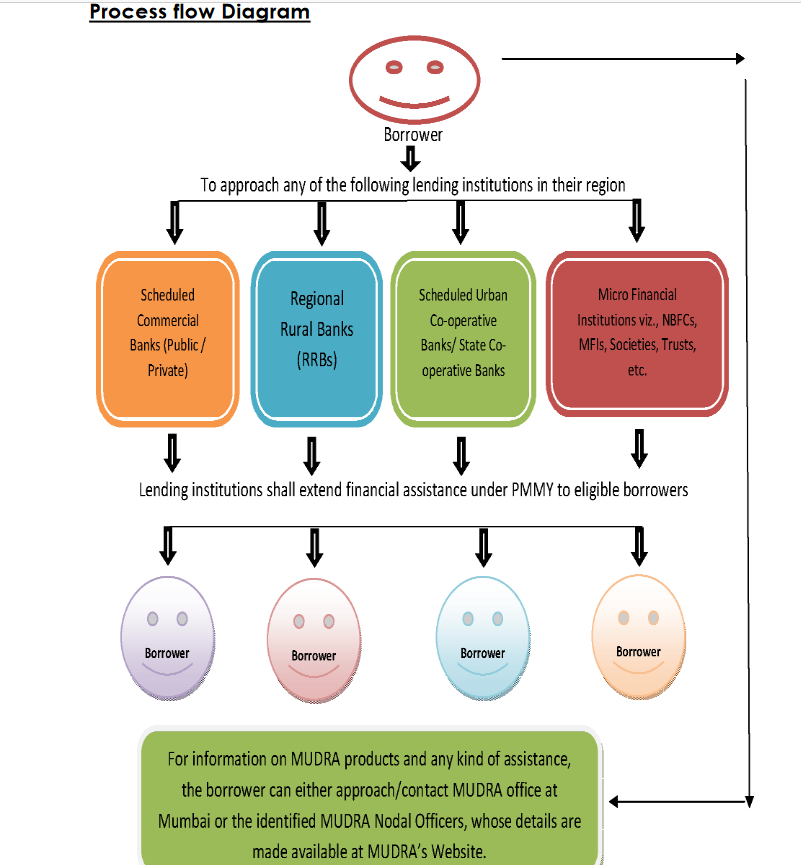

PM Mudra Yojana : Work-Flow

- The funding institute provides loan services, the delivery channel should be expanded more as there are already many Last Mile Financier already set up in the market.

- The scheme ensures proper methods to protect their clients and their information.

- The workflow is simple, the borrower applies for the loan from any of the authorities.

- The leading authorities are needed to provide financial assistant to the verified and eligible borrowers under PM Mudra yojana(PMMY) .

What are the Schemes Under Mudra Loan?

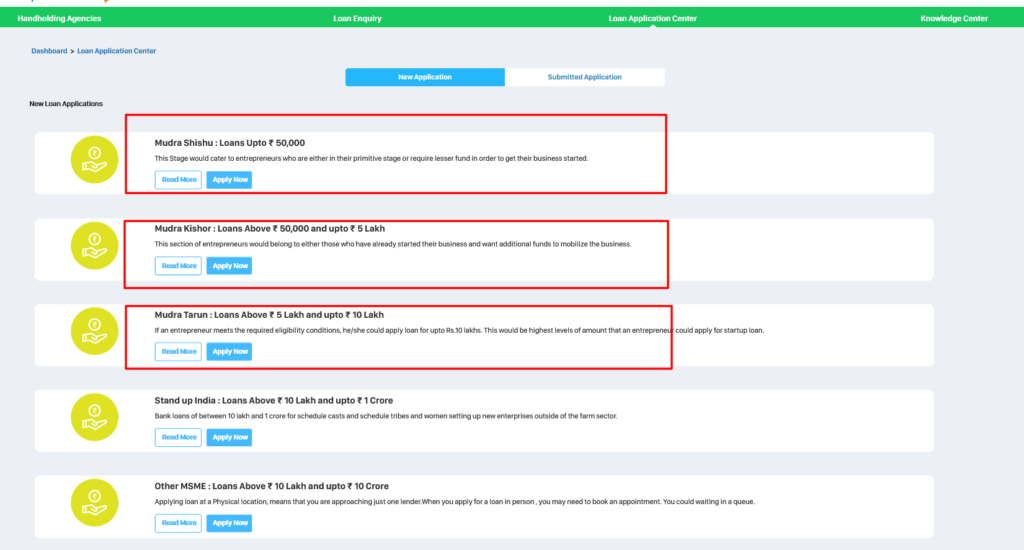

The Pradhanmantri Mudra Loan Yojana offers three sub-schemes under MUDRA YOJANA –

- Shishu Loan

- Kishore Loan

- Tarun Loan

At least 60% loan is allotted to Shishu loan and the rest to Tarun and Kishore loan.

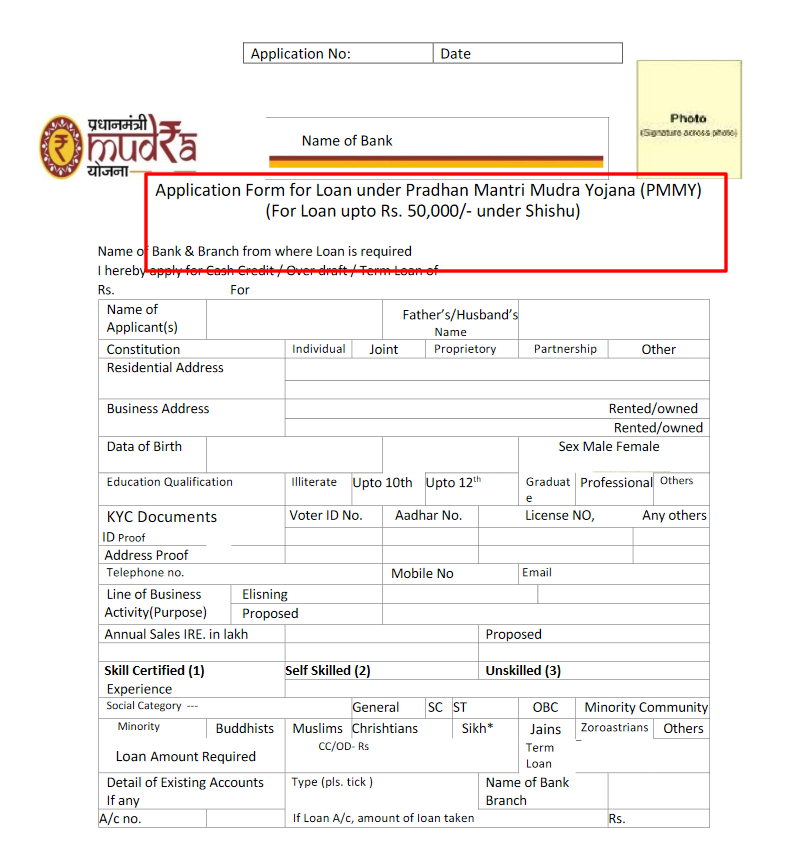

- Shishu Loan

The limit of this loan is RS 50,000 which is for the borrower who is just at the starting point of his business.

The following criteria should be fulfilled by the borrowers are-

- The estimate of machinery products and other commodities that needs to be purchased.

- Details about commodities

- Details about your supplier.

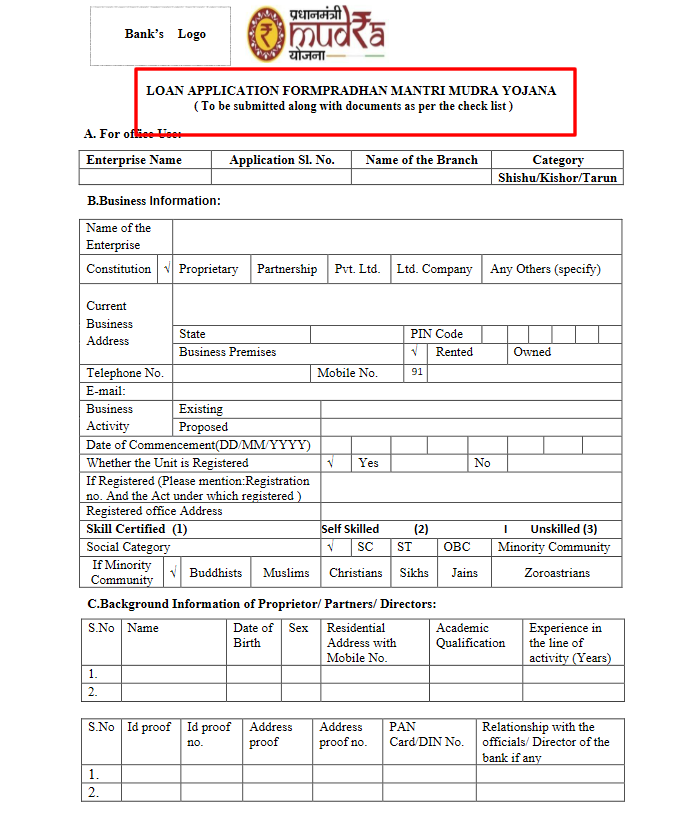

2. Kishore Loan

The limit of this loan is Rs 50,001 to 5 lakh which is for the borrower of the business category who wants additional funds for expanding their trade and business to generate more money. The list of details and documents required to get a loan are-

- The previous two years balance sheet of the business.

- Document of income tax and sale tax returns

- The previous 6 months bank statement copy

- Balance sheet for the coming year with estimation according to the business

- Sale made in the year just before applying for the loan.

- Checking the business durability by technical and economical aspect.

3. Tarun Loan

The limit of a Tarun loan is from 5 lakh to 10 lakhs and whoever wishes for this loan must have these documents listed below.

- Address Proof

- Identification proof

- Certificate of the category (SC/ST/OBC)

PM Mudra Loan Interest Rate

There are various public as well as private banks providing loans to the borrowers. Here is the list of interest to be paid according to banks.

loan offerings:

| Name of the Bank | Interest | Time Duration |

|---|---|---|

| Syndicate Bank | 8.60% – 9.85% | Based on the bank’s terms |

| State Bank of India | 11.25% | Up to 5 years |

| Bank of India | starting 10.70% | 36 – 84 months |

| Andhra Bank | 8.40% to 10.35% | 36 months starting |

Documents Required

The module of the document required changes according to the type of loan one is applying for.

Vehicle Loan

- PM Mudra Yojana application Form

- Application form for loan

- Proof of Income

- 2 Coloured passport size photos

- Proof of Identity

- Proof of residence

- Previous 6 months bank statement

Business Installment Loan

- PMMY application form

- Residence Proof

- ITR of 2 years

- Certified financial CA

- Passport size photo

- Identification Proof

- Previous 6 months bank statement

- Application form of BIL

- Qualification proof

- Proof of establishment

- Proof of Ownership

Business Loans Group and Rural Business Credit

- PMMY application form

- Application form for BIL

- Last 2 years income tax

- Identification proof with photo

- Verification of Age

- Previous years Business proof

- Residence or office proof

Application process of PM Mudra Loan

The borrower can apply on the official website but by this, every bank will not provide you loan, the procedure has to be completed in the bank itself. There is a list of banks that are under this scheme

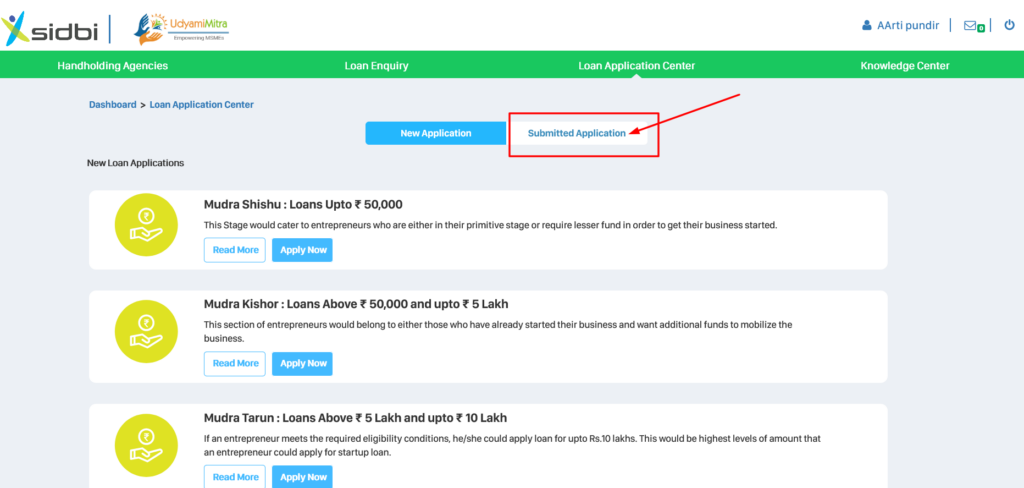

Online Process

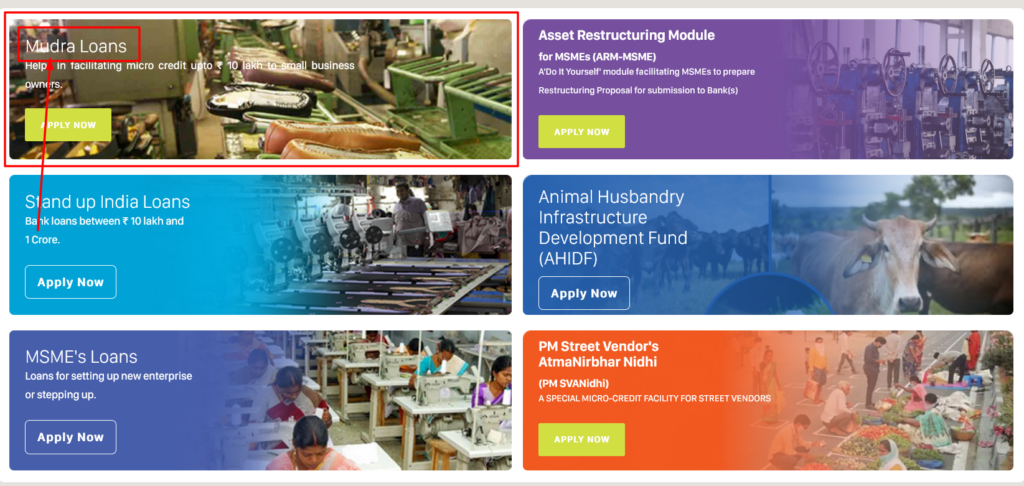

The borrower can apply for loan selecting through any of the categories-

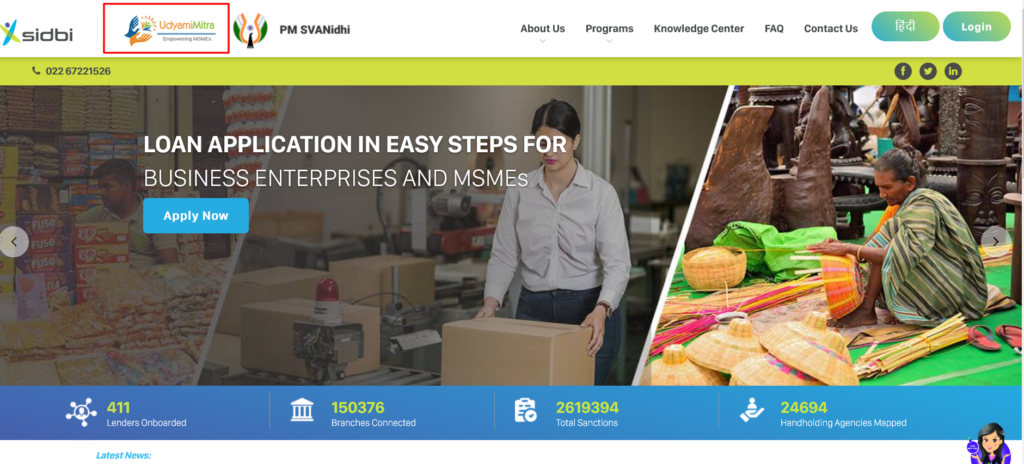

- Firstly the candidate must visit the official website of Mudra or udyamimitra.

- Then click on the type of loan you want and click on it.

- Then select the respective form and download it in Mudra and in udyamimitra you can directly fill the form after registration.

- Lets, look for online registration through udyamimitra portal.

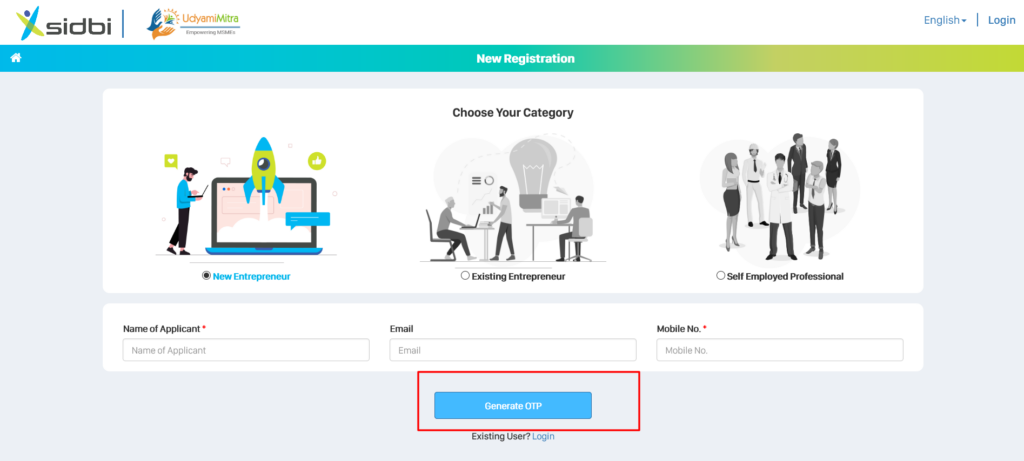

- Firstly, open the portal and go through the homepage screen.

- On the homepage screen, you fill find various service names, select MUDRA loan among them.

- On selecting the option a page will appear for filling in the required details of candidates for new registration.

- Candidate first needs to complete the registration process by filling required details on registration form then Submit the form

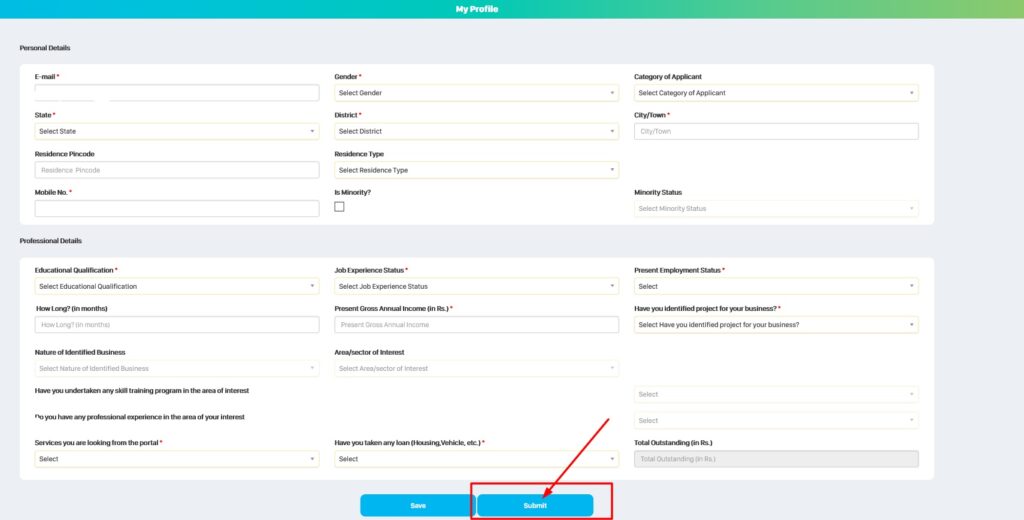

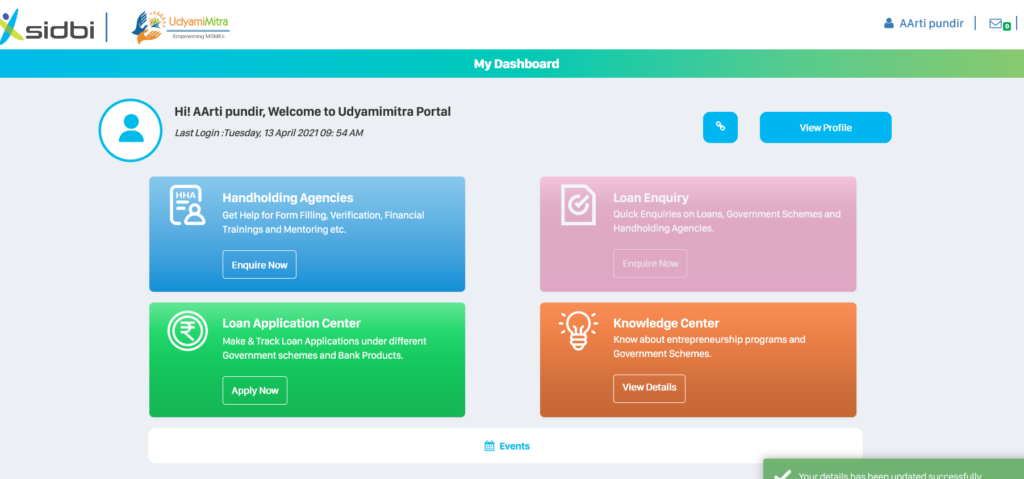

- After, filling in the details in the My Profile page, the next page appears carrying four options:

- Handling enquiries

- Loan enquiry

- Loan application center

- Knowledge center

- Select Loan Application center option, and click on Apply here option.

- The candidate can apply for the desired loan from the option.

- Let’s select the Shishu Loan option, clicking on will lead you to the application form.

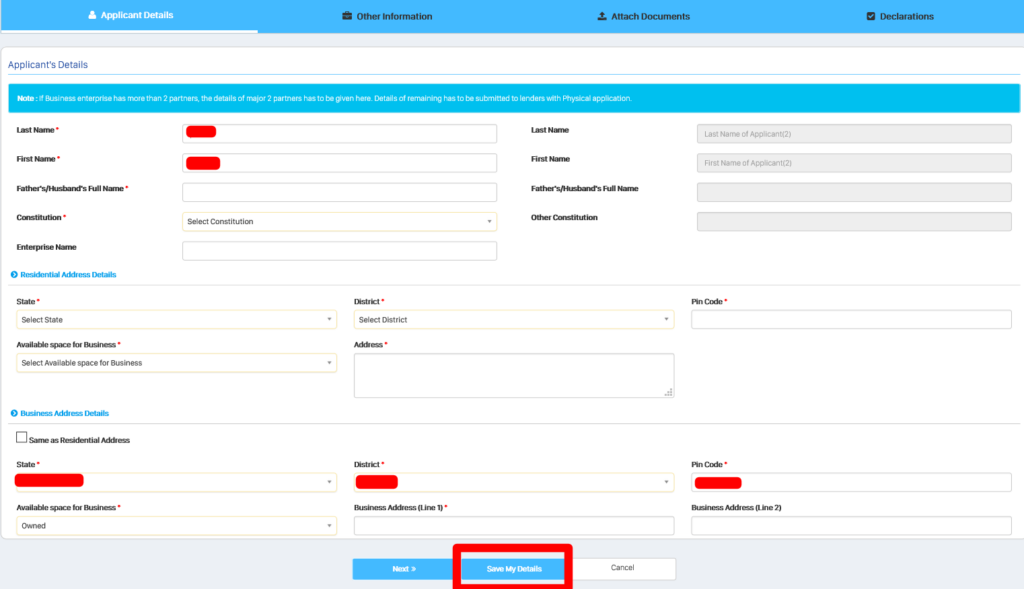

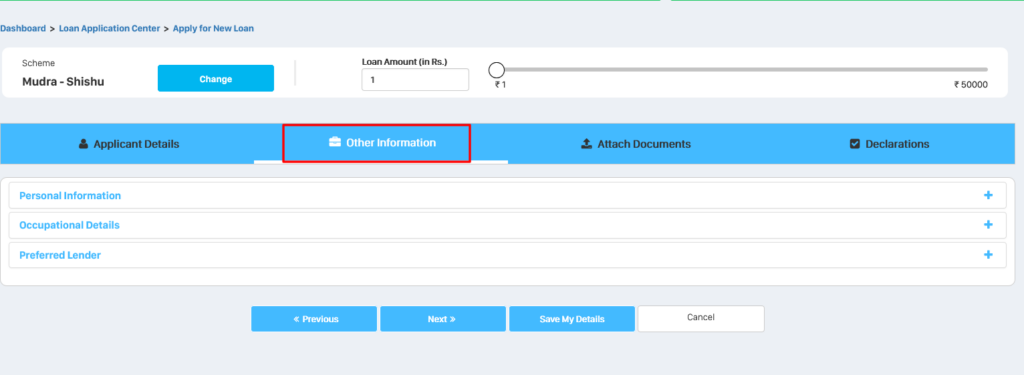

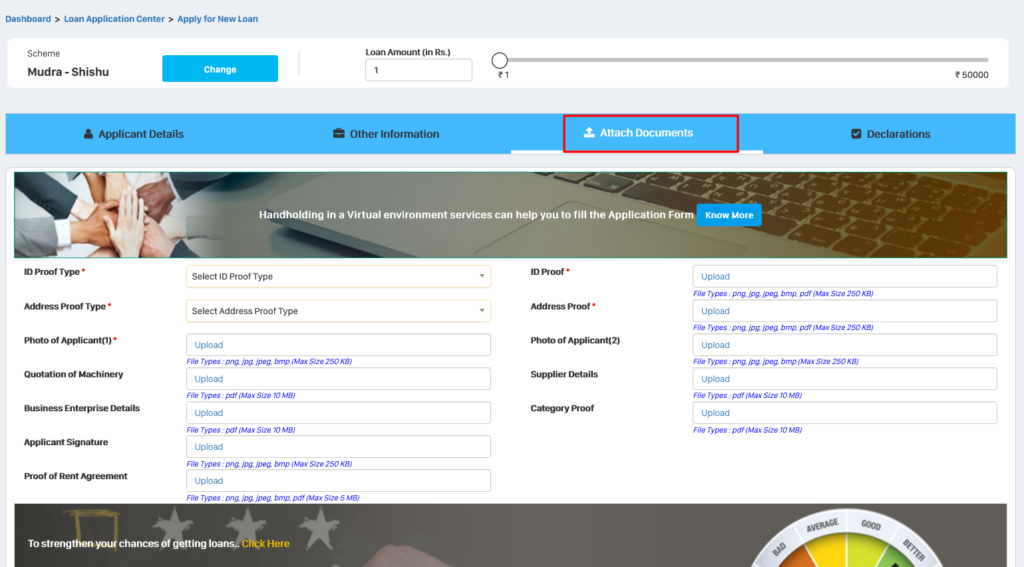

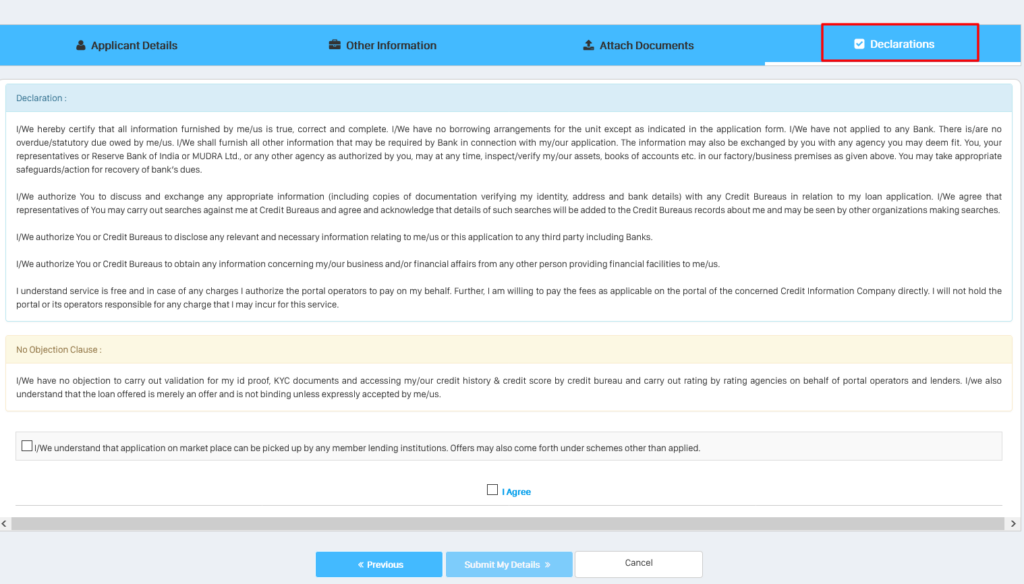

- The application form consists of 4 parts

Application Details

Other Information

Attach Documents

Declaration

- After filling all the 4 steps , click on submit my detail and your application will be sent to the authorities.

Another Application form will be submitted the same way as above. but do keep in mind filling this application form and applying in the portal doesn’t mean any bank will provide you with a loan on the basis of this. Other banks provide loans according to their work procedure.

Offline Service

In offline service, candidates can directly go to the authorities allotted by the government of India to ensure the loan services. The deserved candidates are verified by the appointed agencies according to their set rules and regulation. In fact, the candidate has to follow the rules set by the agency as per their norms. The essential documents should be carried by the candidates for applying for a loan.

Form formats

Form for all categories

Check PM mudra loan Application Status?

The application status tracing is not an option available in the portal right now. Though you can check a bit of information about the submitted application on the portal.

Submitted Application

Currently, the authorities are trying to coordinate with banks in providing links to the candidates in order to track their applications. Thus, after checking the status acting according to it.

Time Duration in Passing of Application Form

Once the application form is filled and submitted it takes 7 to 15 days for sanctioning of the loan. The processing of forms can also vary from authority to authority or can say lender to lender. But for the Shishu form no matter which place it takes 7-10 days at most.

PM Mudra Card

If the loan is sanctioned to you after thorough verification then you are provided with a Mudra Card. It’s an innovative Rupay Debit Card that can be used anywhere making it hassle-free. It’s a benefit provided by the government for working arrangements.

PM Mudra Repayment of Loan

RBI directs the terms and conditions of the loan and lending guidelines. It’s the decision of the lending agency id loan should be allotted or not. Your income generation will decide the amount of loan to be issued to you. The repayment guidelines utterly depend on the cash flow of the business. Basically, the period of repaying the loan varies from 3-5 years. It includes a 6-month postponement depending upon the income outcome.

Important details on PM Mudra Yojana

There are certain details that should be kept in mind while applying for the loan.

- Mudra Loan is an institute known as Micro Units Development & Refinance Agency which is basically a refinance agency.

- It’s not the authority appointed to lend a loan.

- The loan is lent by bank office, NBFC etc under Mudra loan which is under PMMY.

- Additionally, there is no middle man in providing loans. Therefore, be aware of such frauds.

- Mudra is a complete subsidiary under SIDBI.

- Mudra loan is not for every businessman, it is basically for the small-time business runner.

- All banks are not under Mudra Yojana so check the list of bank and seek a loan accordingly.

- The PMMY is handled by SLBC on the state level and by Mudra on the National Level.

- Filling an application form online doesn’t mean you will directly be provided with a loan. One has to follow the terms and condition of the lenders in order to secure a loan.

- There is a processing fee on Kishore and Tarun loan.

- One can withdraw money from Mudra Card as it is a Rupay Debit Card that can be used in an ATM for withdrawal of money.

Contact Details

| Contact information | State-wise List |

| Address | SWAVALAMBAN BHAVAN, C-11, G-BLOCK, BANDRA KURLA COMPLEX, BANDRA EAST, MUMBAI Pincode– 400 051 |

| Finding difficulty in filling the form National toll-free helpline number | 1800 180 1111 1800 11 0001 |

Important links

| Mudra Portal | Click here |

| Mudra Mitra Portal | Click here |

| Udyamimitra Portal | Click here |

| SBI loan portal for Mudra yojana | Click here |

| PM Svanidhi Yojana | PMKSNY 2022 Beneficiary Status |

FAQs

The Mudra Yojana is a subsidy of SIDBI introduced by the government of India in order to provide finance(Loan) to the small business owner so they could increase their capital area leading to development.

The application form, applying for the loan can be filled both offline and online ways. The process is explained steps wise in this article.

The processing fee for Shishu And Kishore scheme is NIL and for Tarun, it is 0.50 % in addition, application tax according to the loan amount.

It depends on the lender providing the loan but the Shishu loan passes within 7 to 10 days maximum. Other loans may vary accordingly.

No, according to government norms one has to hold the property in their hand to get the loan on that shop.

The Mudra Yojana has certain agencies under him who ensures services under PM Mudra Yojana. Every bank doesn’t follow the same rule thus they do not accept this form. you can check the list of authorities names in the article.

You can check the loan enquiry option on the udyamimitra portal, or through this direct link.