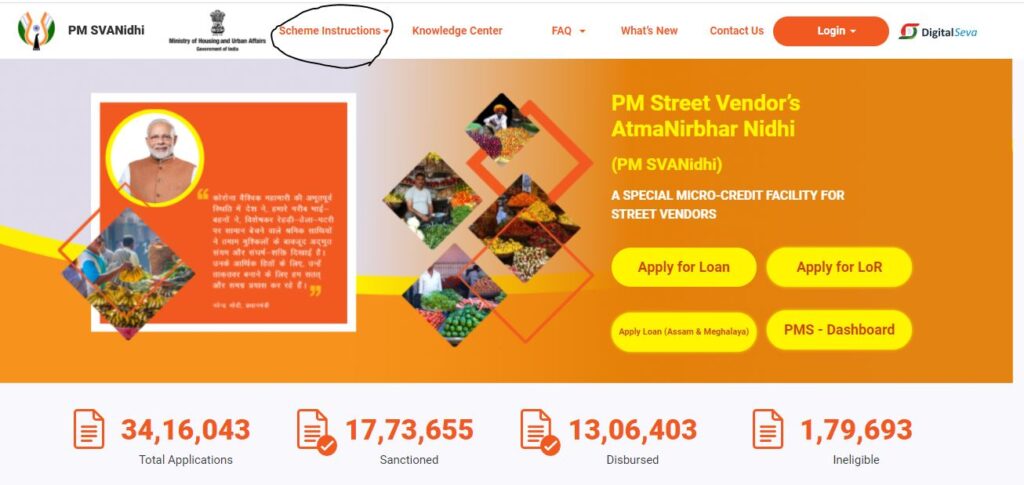

Prime Minister Narendra Modi has initiated svanidhi scheme on 1st June 2020 under the Ministry of housing and urban affairs. Svanidhi scheme will provide loans up to 10000 rupees for 1-year tenure is provided. This will facilitate Collateral free working capital. It will support Street vendors (approximately 50 lakh) to resume their work. To enhance the capability of street vendors and empower them the facility of loan is extended. This is for the overall development and economic upliftment of vendors.

Table of Contents

PM Svanidhi Yojana 2023

According to some economists, this is a very crucial period for the economy of the country. Due to the lockdown and the great pandemic Indian economy has collapsed very much. Because of this many Urban and rural areas Street vendors faced problems. They were unable to get back to their work because of a shortage of money. To support them in uplifting their business loan for 1-year tenure is provided. This amount is up to 10000 rupees. To make it digital, a mobile application for PM SvaNidhi Yojana was launched on July 17. This will help Street vendors to go digital for transactions. With this, they will get monthly cashback also.

Eligibility

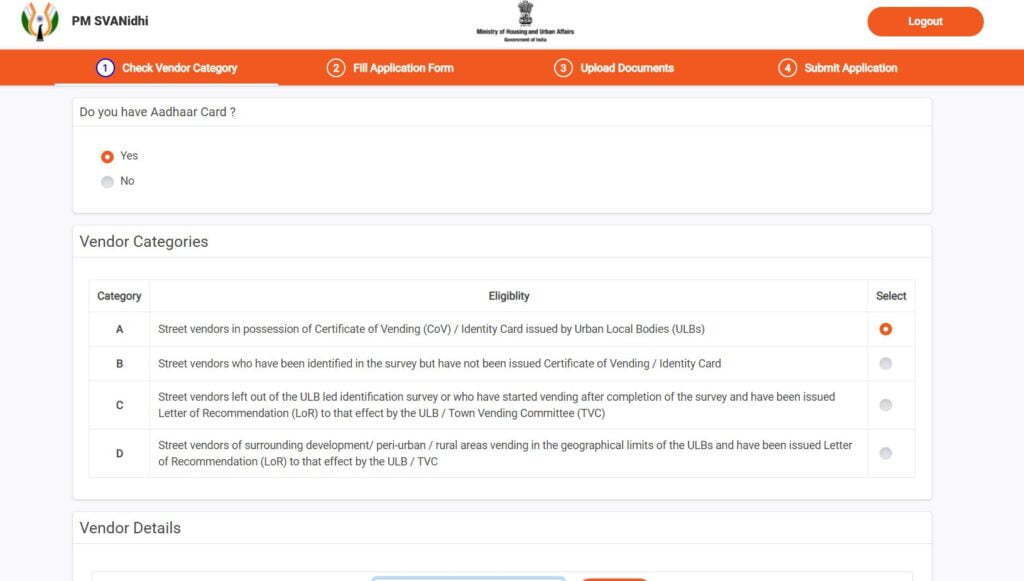

There are some eligibility criteria an applicant must have to get this loan. This scheme is for that Street vendor who comes under the act of 2014 (protection of livelihood and regulation of street vending).

- Street vendors must possess a certificate of vending for identity proof issued by urban local body

- Those vendors who are identified under survey but not issued any identity card. A certificate of provisional vending would generate through the IT platform

- Vendors of surrounding development should have geographical limits

- Certificate from urban local bodies a letter of recommendation should initiate from town vending committee

Objectives of PM SvaNidhi Yojana

Under this scheme Ministry of housing and urban affairs has fully funded Street vendors. The major objective is to facilitate capital of 10000 Rupees to a street vendor to incentivize the regularity for payment of a loan. It also provides digital awards by online transactions. This Scheme will help Street vendors to formalize their objectives. It will open a new opportunity to their sector with this economic support.

प्रधानमंत्री ग्रामीण आवास योजना लिस्ट 2023

For tenure of 1 year up to Rs. 10000/- loan is provided to Urban Street Vendors. This money is provided as working capital and it can be repaid in monthly instalments. To get this loan no Collateral will be taken. If the vendor will pay the instalment on time, they will eligible for the next working capital loan with enhancing limit. If they’re unable to pay on time penalty will be charged.

Subsidies On Interest Rate

Loan taking vendors will get a subsidy in interest. Under this scheme, vendors are eligible to get an interest rate of up to 7%. Interest subsidies will be given to the borrowers quarterly. The subsidy is provided directly to the account of the loan taker. Interest subsidy will be available up to March 31st 2023. In case of early repayment, the Admission will amount of subsidy will be created at one time.

Promoting Vendors For Digital Transition

By this scheme, the incentive will be provided for those vendors who will do the more digital transition. This incentive will credit according to cashback. The network of digital payment such as UPI, Paytm Google pay etc will be used for Digital transactions. Monthly cashback up to 50 rupees to 100 rupees is given to vendors. This will uplift digital transition procedure it is further classified as below:-

- Making 50 eligible transactions in a month will credit 50 rupees cashback.

- For the next 50 transactions, 25 rupees is provided on reaching hundred eligible transitions. This means that for 100 eligible transactions in a month 75 rupees cashback will come to the account of the borrower.

- For the next 100 transactions again 25 rupees is credited. This makes it a total of 200 eligible transitions that will let the vendor earn 100 rupees.

Steps Before Applying For Loan under PM svanidhi

There are three important steps that candidates must check before applying online. They are subcategories and explained below:-

First understanding the requirement of loan

The applicant before filling the application form, it is very much important to understand the information, documents required. Keep all the information and documents ready before starting the application form process. The list of documents which is required is discussed above

Link Aadhaar card with mobile number

Applicant must have linked their mobile number with their Aadhar card. During the process, a one-time password is sent to the registered mobile number. After Aadhar details, if this is not connected the procedure may collapse in between. Candidates can visit the IT office of Aadhar for updating their number. It is a very easy process to update your mobile number at any nearest Aadhar centre.

Checking eligibility for PM svanidhi scheme

Applicants must come under four categories of street vendors to get a loan. Before applying for the loan applicant must come under any vendor status category.

- Applicant must have a name in the survey list of urban local body

- If they do not have a name on the survey list they must have an identity card or certificate of vending issued by the town vending committee

- If the applicant is left out from the list of survey they can get a letter of recommendation from the urban local body

- Else street vendor of surrounding development areas is in the geographical limit of the urban local body. They can have a copy of the letter of recommendation to get a loan.

Indane Gas Booking Online here

Application Procedure of PM Svanidhi Yojana Online

The procedure to apply for the SvaNidhi scheme is very easy. To get a loan through an online process follow instructions. Procedure to online apply of PM SvaNidhi is given below:-

- First, visit the official website of PM SvaNidhi Yojana

- On the home screen, there is an option to apply for a loan

- Click on this link, This will open a page for login

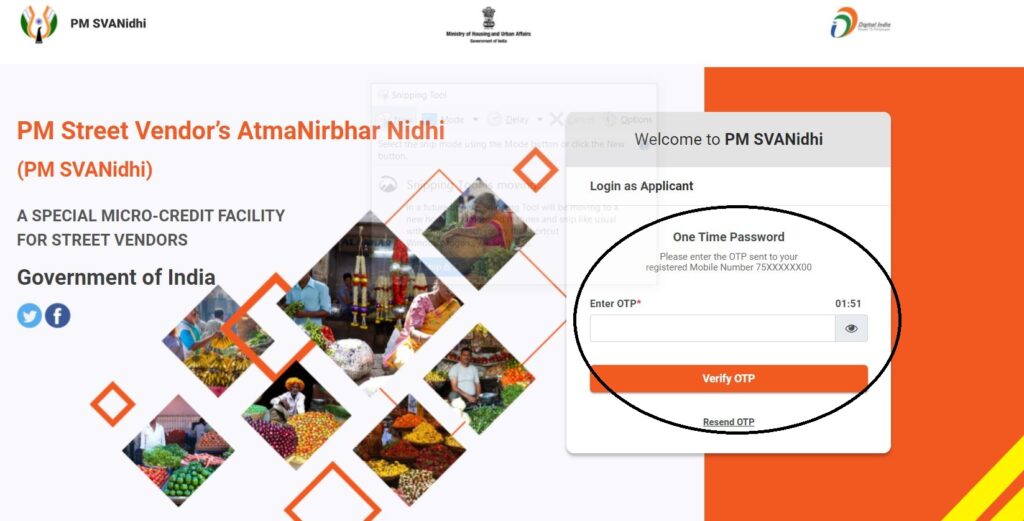

- On this page, the mobile number is needed. Provide mobile number and click on captcha to request OTP

- OTP is sent to your number. Provide this one time password for verification

- After doing this much next page will open. This will show the candidate has a login

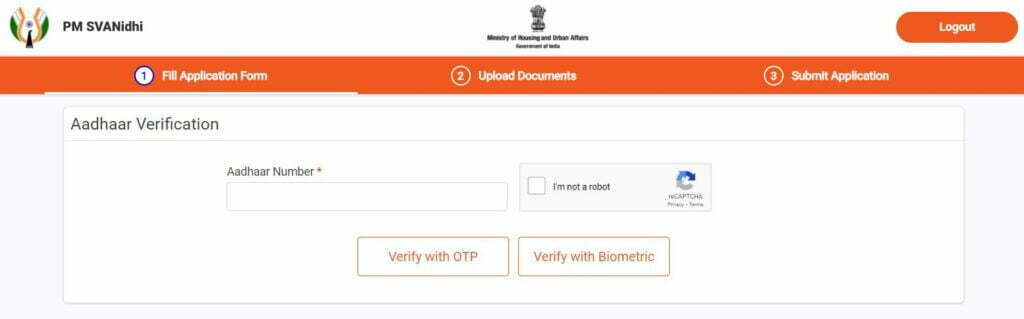

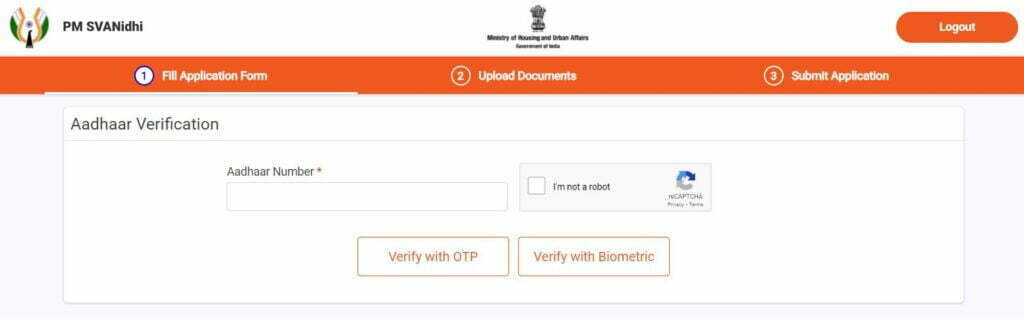

- This will open a new page where it is asked work and it has an Aadhar card provide this information application form will open.

- Fill this application form and on the next page upload documents

- Later it is required to submit the application form

- Submitting this application form will initiate the procedure of the loan.

- It will come under scrutiny after verification loan will pass

- Take a printout of this application form for future reference.

Procedure To Apply For Letter Of Recommendation

To get available of PM SvaNidhi scheme applicants have to request for letter of recommendation. This letter is provided to them by following the given procedure:-

- First, visit the official website

- You will see an option to apply for LOR

- Click on this

- Mobile number of candidate will be asked

- An OTP is sent to the number

- Provide this one-time password OTP verification

- Details of Aadhar card is required for verification

- Applicant can verify their Aadhar through OTP or biometrics

- After verification upload, documents and press submit

- After scrutiny letter of recommendation will generate for the beneficiary

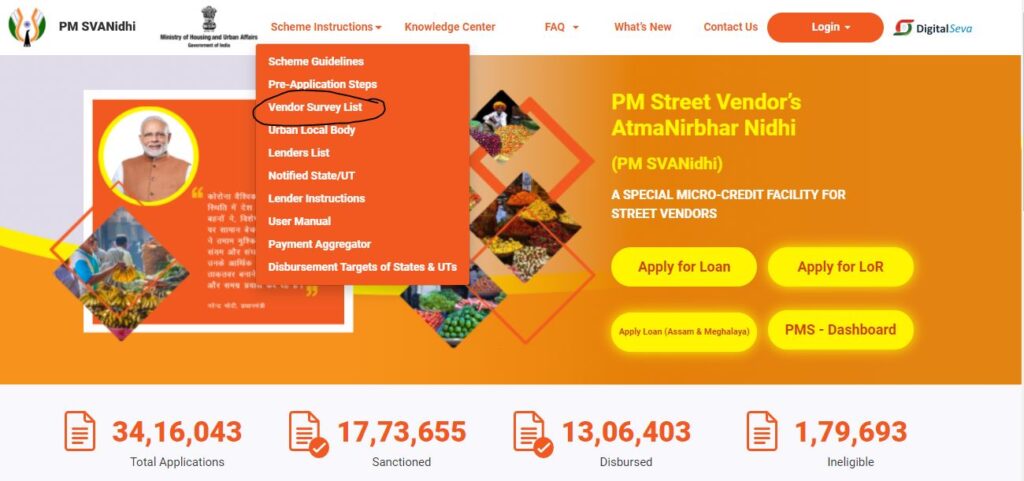

How To Check Vendor Survey List वेंडर सर्वे लिस्ट देखने का तरीका

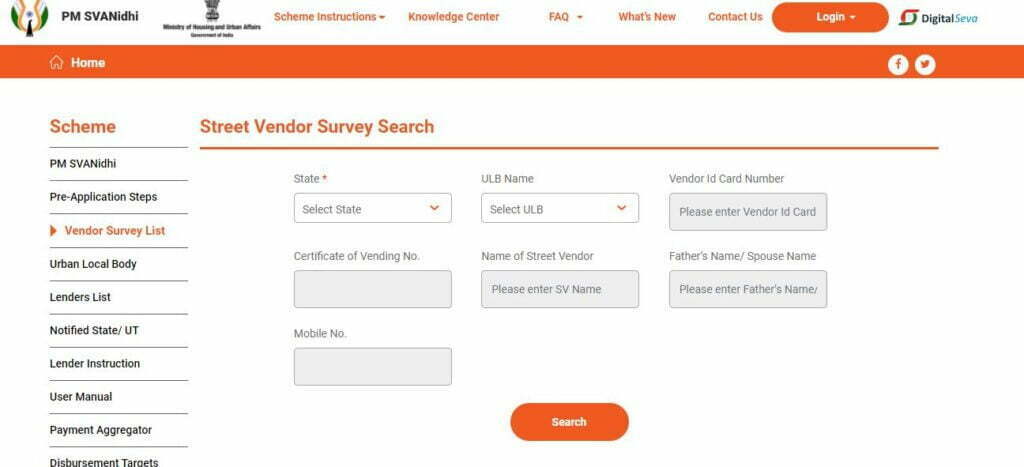

An applicant who wants to apply for a loan must check the name in the vendor list. This vendor list will have the survey name of all the applicants and respective areas. The procedure to check the vendor survey list is given below:

- First open official website

- On home page in this section for scheme instruction

- In this tab there is option for vendor server list

- Click on this option

- Details of candidate are asked

- Details are as state, ULB number, vendor ID card, number, certificate of vending number, name of street vendor, father’s name, mobile number

- Provide all the details and search

- If applicant is having name in the list they are eligible for loan

- If they do not have name they can apply for letter of recommendation

- This will help them to get from urban local body

Lenders Of Loan

The government’s micro and macro financing organisation can lend this money. These lending institutions are encouraging to enhance their network of fields. कौन कौन लेंडर है योजना के It is providing business correspondent, agent extensively to increase the coverage of this scheme.

Scheduled commercial banks, regional rural banks, small finance banks, non-Banking Finance Corporation micro-financing SHF etc are working to provide SvaNidhi. As you know that Andhra and Telangana do not have a Micro Finance institution. But they have a strong network of SHG. They are utilising that source to mobilize and generate loans. Other states are using their robust network to provide loans to Street vendors.

Pradhanmantri SvaNidhi Mobile Application

To make this scheme more easy and accessible government has launched a mobile application. मोबाइल एप्लीकेशन डाउनलोड was launched on 17th July. Under mobile application, the interface is made very user-friendly and a list of all the lending Institutions and survey list is provided. Also, the procedure of applying for a loan online is given. Applicants can access mobile applications to get credit digitally.

Frequently Asked Questions

Coronavirus lockdown has adversely impacted the business of street vendors. They do not work for a very big amount. But a small capital base business. Due to lockdown, they consumed their capital. Therefore they do not have any credit to start and resume. Therefore in order to support them, this scheme was launched.

To provide loans, scheduled commercial bank small financial bank Cooperative Bank regional rural bank Microfinance Institution and non-banking financial companies are lending institutions.

Working capital up to 10000 is provided for one year to vendors. This amount will increase from the next working capital if paid this loan early.

Yes, in that case, you can get a provisional certificate of vending from an IT-based platform. This agent will help you to fill the application form. After uploading documents process will initiate for loan payment.

With a letter of recommendation, important documents which are required for KYC are Aadhar card driving licence voter ID card MANREGA card pan card.

No Collateral security is needed to get this loan.

There is a 7% subsidy on the interest rate. This interest subsidy will be directly credited to the account of the beneficiary every quarter. If the applicant has done an early payment of the loan this subsidy will be credited to them at one time. Paying a loan of 10000 in all 12 will provide almost 400 subsidy amount.

Yes, the applicant will be charged a penalty for not paying the loan on time. However, if they have paid the loan before time there is no penalty.

This complete procedure is done through the official website and mobile application. After verification and whole processes applicant can get a loan within 30 days.

PM sav-nidhi Background

Street vendors are termed as the informal economy of urban areas. They provide the availability of goods and services at a very affordable price from door to door. They are often called Vendors, Thela Wala, Rehadi wall, etc. The list of goods provided by them is food and textile, footwear, tea, pakoda, food book, stationery etc. It also includes major services like barbershop, cobbler, laundry Pan Dukaan. Coronavirus lockdown was implemented in March 2020. This has affected the livelihood of these Street vendors. These people are daily earners and daily Expenders. Because of lockdown, their all saving was used and there was no source of income for them. This has collapsed their job. In order to support them for work pm, the SvaNidhi scheme was launched.

हाउसिंग एंड अर्बन अफेयर्स मंत्रालय ने स्ट्रीट वेंडर्स को सशक्त बनाने के लिए न केवल उनके लिए बल्कि उनके समग्र विकास और आर्थिक उत्थान के लिए भी स्ट्रीट वेंडर्स को सशक्त बनाने के लिए पीएम स्ट्रीट वेंडर की Atma Nirbhar Nidhi (PM SVANidhi) योजना शुरू की। यह योजना लगभग 50 लाख स्ट्रीट वेंडरों के INR 10,000/- तक के संपार्श्विक मुक्त कार्यशील पूंजी ऋणों की सुविधा प्रदान करने का इरादा रखती है, ताकि आसपास के पेरी-शहरी / ग्रामीण क्षेत्रों सहित शहरी क्षेत्रों में अपने व्यवसायों को फिर से शुरू करने में मदद मिल सके।

Helpline

In case of any discrepancy, the beneficiary can contact official authorities. Details for contacting ministry for any grievances are:-

Director

Room number 334-C

Ministry of housing and urban affairs

Nirman Bhavan

Maulana Azad Road

New Delhi 110011

Email- Neeraj.Kumar3@gmail.com

Telephone – 011230 62850

You can also ask us your query and problems related to PM svanidhi yojana and our team will help you in finding solutions.