In order to provide a helping hand in the tough times of farmers, the government has started to outreach them with loan waiver schemes. Karnataka Crop Loan Waiver System is a scheme launched by the JD(S)-Congress coalition for the farmers of the state. Karnataka Crop Loan Waiver Scheme provides loans on crops to eligible farmers. The Karnataka crop loan mafi system has provided tremendous benefits to the farmers. This has resulted in all states adapting the CLWS schemes like Karnataka. The main purpose is to make the farmers financially strong by providing them with crop loans. The best thing is a shortlisted farmer list is provided by the concerned department and these farmers will not have to pay a loan. This has helped in removing the burden from the farmers.

Table of Contents

Karnataka Crop Loan Waiver System

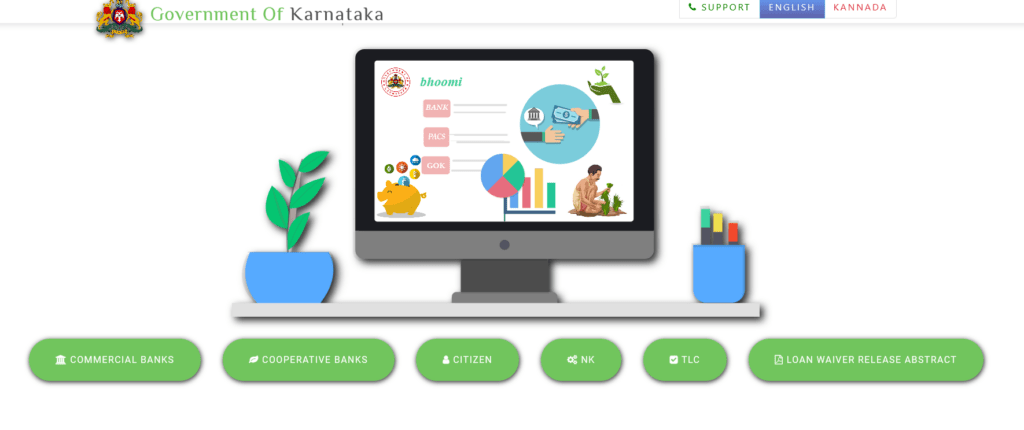

Loan Waiver Scheme has benefited a large number of farmers in the Karnataka state and has also lessened the burden which was inflicted upon them from the drought. Therefore, the government has launched a separate website that will only deal with the services granted under the scheme.

The web portal provides services for a different category with many subcategories such as

- Commercial Banks

- Cooperative Banks

- Citizen

- NadaKacheri (NK)

- Services For Taluk Level Committee

- Loan Waiver Release Abstract

This is providing efficient help to the in debt farmers so that their debt is cut short. The help is majorly for the farmers who are small scale farmers such as marginal and poor farmers. There are many services provided on an online portal try to get accustomed to those services. This scheme will surely remove the loan which has burdened farmers thus letting them grow more.

Karnataka Crop Loan CLWS Status

The Karnataka Crop Loan Waiver System is providing about Rs 2 lakh loan for the poor and marginalized farmers. The said state has been suffering from drought which has hit the farmers pretty badly. This scheme has thus, lend them a helping hand to stand up again.

| Name of the scheme | Karnataka Crop Loan Waiver Scheme |

| Handled By | Government of Karnataka |

| Launched on | 17th December 2018 |

| Category | Government of Karnataka |

| Launched for | Farmers of Karnataka |

| Scheme published on | 28th December 2020 |

| Objective | To provide loans to farmers |

| Benefit provided | By claiming a loan of up to Rs 2 Lakhs |

| Provide Benefits to | Marginal and Poor farmers |

Karnataka Crop Loan Waiver Objectives

- Reduce the burden of the farmers

- Provided help to farmers after double hit of drought

- Marginal and poor farmers are provided more loan

- Loans ensured for the next seasonal sowing

Crop Loan WaiverEligibility

- Must be citizen of the state

- Loan is provided only for agricultural functions

- Farmers family member should not be a officer/ govt job holder

- Loans below Rs 2 lakh provided

Documents Required

The documents required for applying for the scheme are

- Residence proof

- Income Certificate

- Bank Passbook

- Identity Proof- Aadhaar Card

- Passport photo

- Secondary Documents needs to be attached

Application Procedure for KAR Crop loan mafi

To apply for CLWS, the farmers should follow the steps provided below:

- Firstly, visit the industrial or commercial banks of the concerned district.

- Then, visit the nearest concerned department or bank and fill in the application form for the crop loan.

- After filling in the details properly, submit the application.

- This application now can be uploaded to the system through a financial operator of the concerned authority.

- Moreover, now the application can be verified and reviewed by the federal government business.

- If the application is approved your loan will be provided to you.

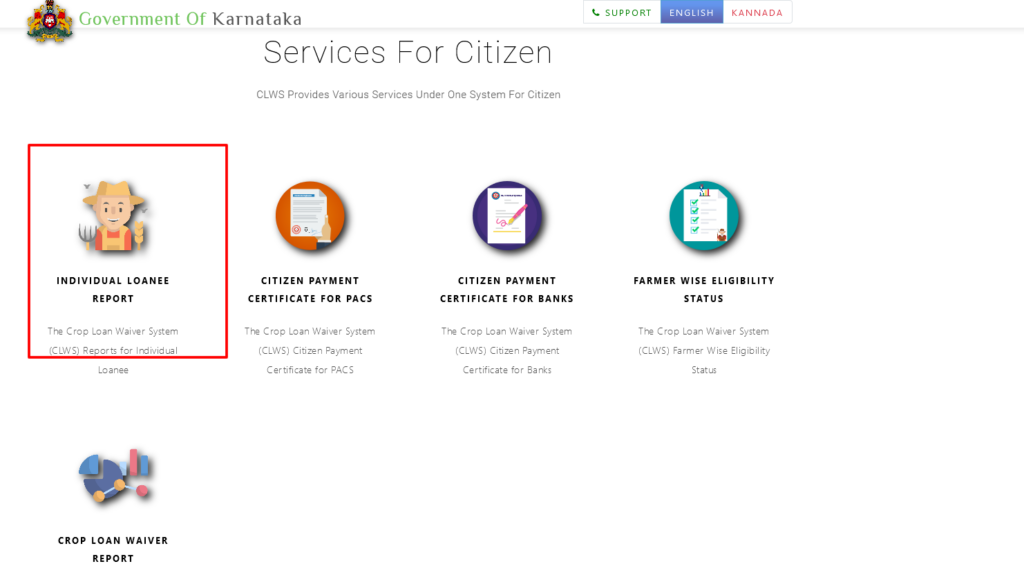

Process To Check Karnataka Crop Loan Waiver Status/Report

To check the status of the farmer’s application, follow the steps:

- Firstly, visit the official website.

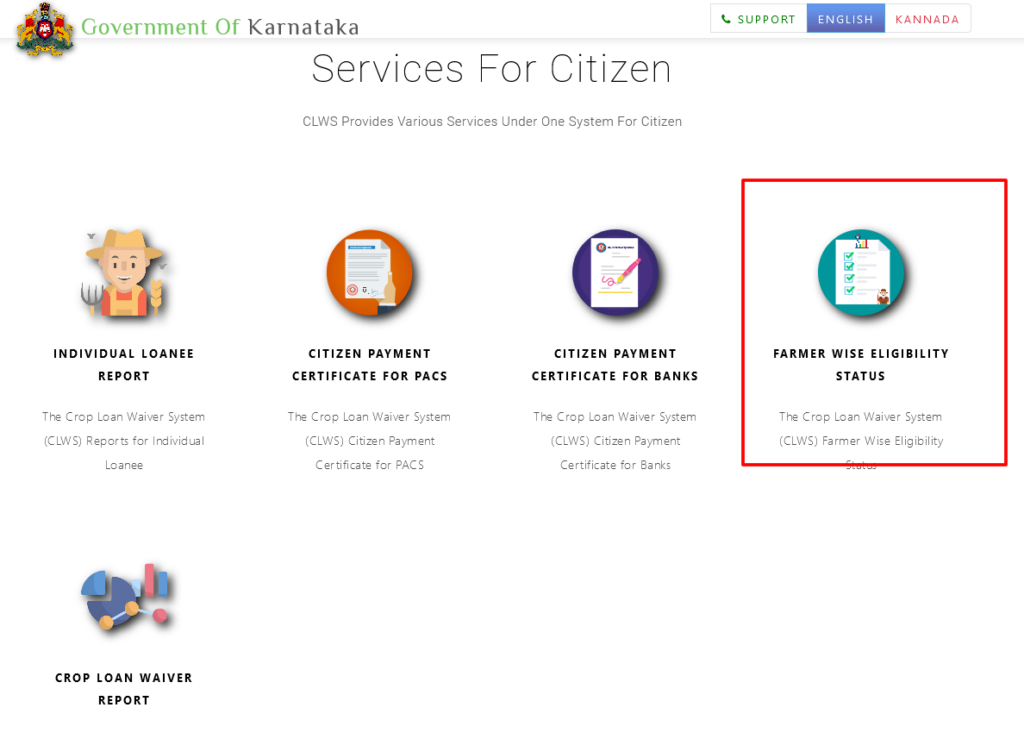

- Once the website opens, scroll down in the list and click on the Services For Citizen option

- Then, there will be four option shown below it

- Individual Loanee Report

- Citizen Payment Certificate for PACS

- Citizen Payment Certificate for Banks

- Farmer wise Eligibility Status

- Crop Loan Waver Report

- Now, from the given option click on Individual Loanee Report.

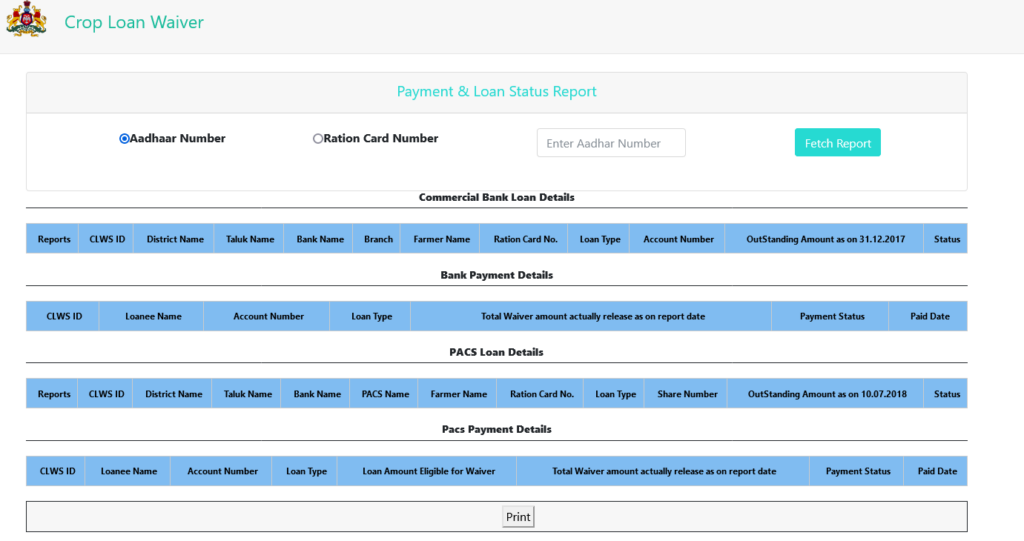

- This will lead you to the next page where information will be provided on the basis of

- Aadhaar Number

- Ration Card Number

- On the next page, you will see the Payment and Loan Status Report.

- These reports are shown in three categories such as –

- Commercial Bank Loan Details

- Bank Payment Details

- PACS Loan Details

- PACS Payment Details

- Then, look through the information you wish to seek

- Enter valid Aadhaar Card Number and Ration Card Details in order to look for the report from the subcategories provided

- Then get the report by clicking on Fetch Report

- Finally, the report will be displayed on the screen.

Details mentioned in Karnataka CLWS Report

In the view Status report, the farmers can find a different set of content based on the category. The content one can see according to the category are:

- Commercial Bank Loan Details

- CLWS ID

- District Name

- Taluk Name

- Bank Name

- Branch

- Farmer Name

- Ration Card No

- Loan Type

- Account Number

- Status.

- Bank Payment Details

- CLWS ID

- Loanee Name

- Account Number

- Loan Type

- Payment Status

- Paid date

- PACs Loan Details

- Report

- CLWS ID

- District Name

- Taluk Name

- Bank Name

- Branch

- Farmer Name

- Ration Card No

- Loan Type

- Account Number

- Status

- Pacs Payment Details

- CLWS ID

- Loanee Name

- Account Number

- Loan Type

- Payment Status

- Paid date

Search Farmer Loan Waiver Name List

- Visit the Official Website of Karnataka CLWS.

- On the home screen of the website, scroll down and select an option Service for Citizen.

- In this option, there are some sub-option available-

- Individual Loanee Report

- Citizen Payment Certificate for PACS

- Citizen Payment Certificate for Banks

- Farmer Wise Eligibility Status

- Crop Loan Waiver Report

- From the given option select Farmer Wise Eligibility Status

- This will lead you to detail seeking page.

- To get details you have to first fill in the relevant information asked-

- Select the District

- Select Bank

- Then, Select Branch

- Select IFSC Code

- Crop Loan Waiver Report

- Finally, click on Fetch Details

- The Details will thus, appear on your screen.

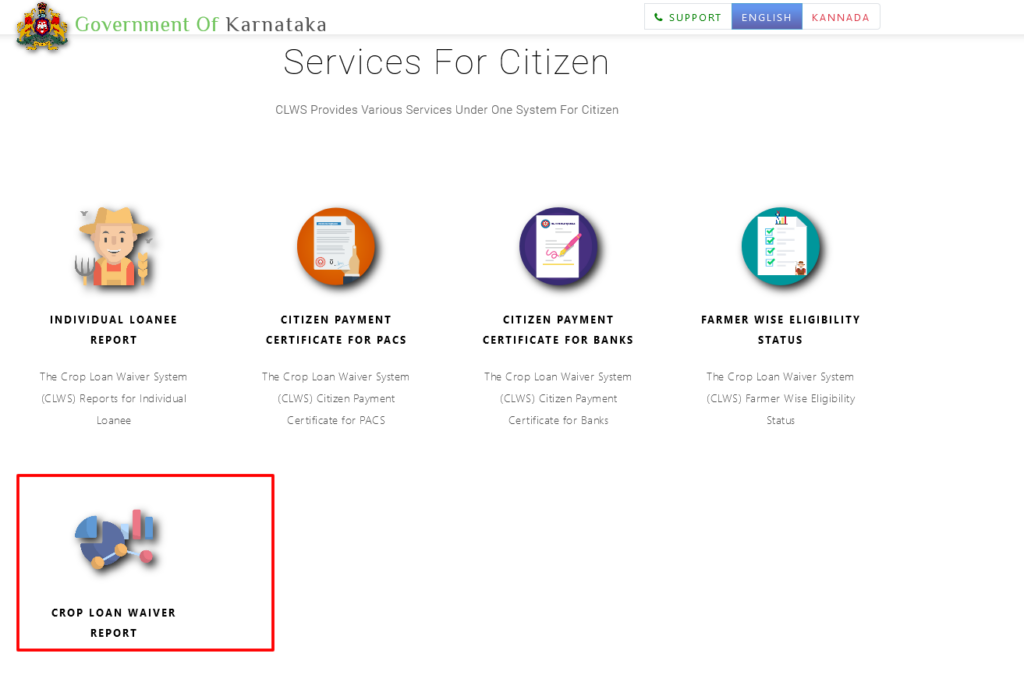

How to check crop loan waiver report?

- Firstly, visit the official website

- Then, from the homepage of the website select the option Services for citizens

- Then, it will provide you with varied option in it

- The options provided are-

- Individual Loanee Report

- Citizen Payment Certificate for PACS

- Citizen Payment Certificate for Banks

- Farmer Wise Eligibility Status

- Crop Loan Waiver Report

- From the provided option click on Crop Loan Waiver Report

- This will lead you to Report for Loan Waiver Payment page.

- The report is provided on the basis of two options:

- Bank Wise

- PACS Wise

- If you select the option BANK WISE or PACS WISE, then select the type of report such as:

- District Wise

- Bank Wise

- Bank Branch Wise

- Taluk Wise

- Hobli Wise

- Village wise

- Farmer wise

- Finally, click on the Get Report option.

- Thuss, the report will appears on your screen.

Contact Details

| Contact Number | 080-22113255 |

| Email ID | BhoomiCLWS@gmail.com |

| Address, | Bhoomi Monitoring Cell SSLR Building, K.R. Circle Bangalore – 560001 |

Important Links

| Official Website | Click here |

| Individual Loanee Report | Click here |

| Citizen Payment Certificate for PACS | Click here |

| Citizen Payment Certificate for Banks | Click here |

| Farmer Wise Eligibility Status | Click here |

| Crop Loan Waiver Report | Click here |

| Karnataka Ration Card | Karma Sathi Prakalpa Scheme |

Under this scheme, farmers can be provided about Rs 2 lakhs per family, through NPCI to their bank account number.

The loan account that is missing, means CBS has not sent the loan account. In such a case CBS will have to send the updated data of crop loans.

If the farmer is dead then the forward proceeding is done considering two cases- if have legal heir then he can apply by giving Farmers Self Declaration using Aadhaar and Ration Card. If there is no legal heir then no loan is supplied.

According to the guidelines, farmers should have these valid documents:

– Aadhaar Card

– Ration Card

– Land SY No Verification fails