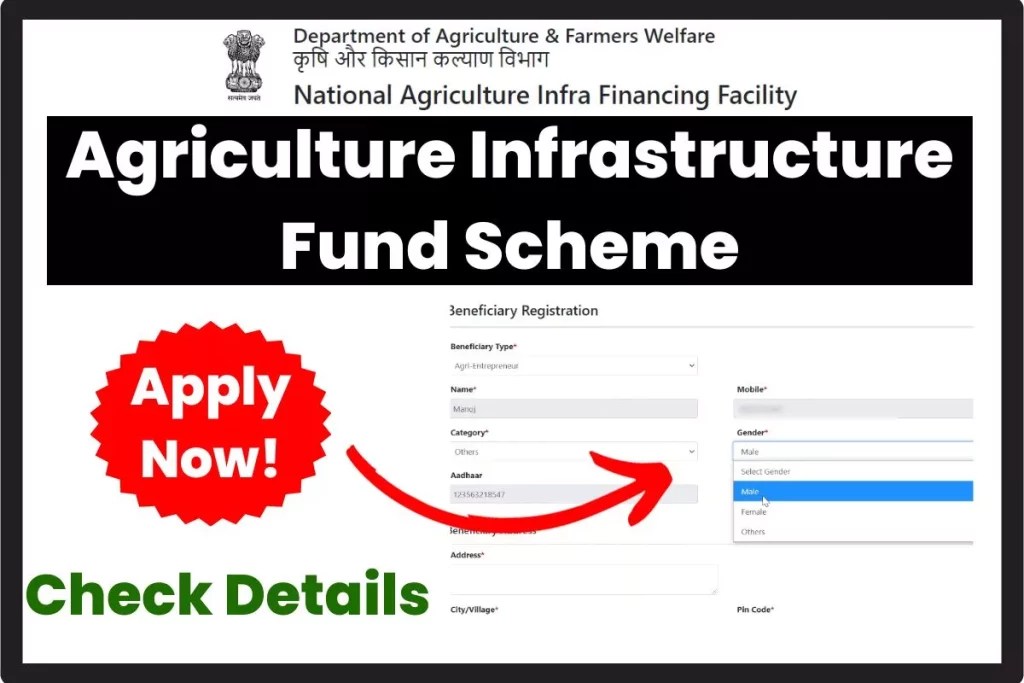

Infrastructure plays an important role in the development of agriculture and makes the production dynamics more efficient. With the help of better and developed infrastructure, the produced goods of the farmers can be utilized efficiently, and the farmers will also get a fair deal. A better infrastructure will also address human resources development and regional disparities. Considering the abovementioned importance, the Finance Minister of India introduced the Agriculture Infrastructure Fund Scheme.

The Finance Minister released a total of Rs. 1 lakh crore Agri Infrastructure funds for the farmers. The authority will provide Rs. 1,00,000 crore for funding Agriculture Infrastructure Projects at farm-gate and aggregation points, Primary Agricultural Cooperative Societies, etc.

The fund will help in the development of Farmgate as well as aggregation points. It will also provide Post Harvest Management infrastructure which will be affordable. The officials have launched this scheme at a central level which will mobilize the long-term debt medium facility in multiple projects.

Table of Contents

Agriculture Infrastructure Fund Scheme 2023

The coverage of credit guarantee will be provided to eligible borrowers under CGTMSE i.e., the Credit Guarantee Fund Trust for Micro and Small Enterprises. The scheme will provide loans up to Rs. 2 crore. The fee charged for this coverage will be the liability of the government. In the case of the FPOSm, the borrowers can avail of the credit guarantee under the FPO promotion scheme of DA&FW.

The loans available for borrowers will have interest of 3% every year to Rs. 2 crore limit. The subvention mentioned here will be available for a total of 7 years only. In case the loan amount exceeds Rs. 2 crore, then the interest subventions will be limited to Rs. 2 crore only. The

The National Monitoring Committee might fix the percentage of funding for private entrepreneurs. The scheme will be active between 2020-21 to 2032-33. The authority will complete the loan disbursement under the scheme in a total of six years.

agriinfra.dac.gov.in Fund Scheme 2023: Highlights

| Name of the Scheme | Agriculture Infrastructure Fund Scheme |

| Name of the Department | Department of Agriculture & Farmers Welfare |

| Launched By | The Government of India |

| Scheme Application Availability Status | Now Available |

| Scheme Application Availability Mode | Online Mode |

| Activated on | 2020-21 to 2032-33 |

| Scheme Level | Central Level |

| Authorized Website | https://agriinfra.dac.gov.in/ |

Eligible Projects for Agriculture Infrastructure Fund Scheme

| Assaying Units | Tissue culture |

| Infrastructure for smart and precision agriculture (Farm/ Harvest Automation) (Purchase of drones, Blockchain, and AI in agriculture etc.) (Remote sensing and Internet of Things (IoT)) | Infrastructure for smart and precision agriculture (Farm/ Harvest Automation) (Purchase of drones, Blockchain, and AI in agriculture etc.) (Remote sensing and Internet of Things (IoT)) |

| Primary Processing activities | Warehouse & Silos |

| Seed Processing | Cold Stores and Cold Chain |

| Custom Hiring Center | Organic inputs production |

| Infrastructure for smart and precision agriculture (Farm/ Harvest Automation) (Purchase of drones, Blockchain and AI in agriculture etc.) (Remote sensing and Internet of Things (IoT)) | Packaging Units |

| Logistics facilities – Reefer Van and Insulated vehicles | Bio-stimulant production units |

Who can Apply for the कृषि अवसंरचना निधि योजना?

| Agricultural Produce Market Committee | Multipurpose Cooperative Society |

| Agri-Entrepreneur | National Federations of Cooperatives |

| Central Sponsored Public-Private Partnership Project | Primary Agricultural Credit Society |

| Farmer | Self Help Group |

| Farmer Producers Organization | Federations of Self-Help Groups |

| Federation of Farmer Produce Organisations | Start-Up |

| Joint Liability Groups | State Agencies |

| Local Body sponsored Public-Private Partnership Project | State Federations of Cooperatives |

| Marketing Cooperative Society | State-sponsored Public-Private Partnership Project |

Objectives of the Agriculture Infrastructure Fund Scheme

- Farmers (Including PACS, FPOs, etc.)

- Farmers will be able to sell the products to a larger amount consumers directly. It also increases the realisation of the value for farmers. Lastly, the overall income of the farmers will also improve.

- Farmers will be able to sell products in the markets with lesser post-harvest losses, and the number of intermediaries will reduce. As a result, farmers will become more independent.

- Farmers will be able to decide when to sell the product in the market with the availability of modern packaging and cold storage.

- Government

- With the help of the scheme, the government will be to support the priority sector by introducing interested subvention, credit guarantees, etc. This will initiate private sector investment in the agriculture sector and the innovation cycle.

- The National Food Wastage percentage has been increasing day by day. So, the scheme will help reduce the percentages and let the agricultural sector compete at the global level.

- The PPP projects will be structured more viable, attracting more investment in the agriculture infrastructure.

- Agri entrepreneurs and startups

- When the agriculture sector gets enough funding, entrepreneurs will be able to do more innovation by introducing new-age technology.

- The ecosystem players will also connect, improving the chances of collaboration between farmers and entrepreneurs.

- Banking Ecosystem

- All lending institutions will be able to lend at lower risk with the options of credit guarantee, incentive, etc.

- Cooperative Banks and RRBs will get a bigger role with the help of Refinance facilities.

- Consumers

- Consumers will be able to get better quality products at lower prices when the post-harvest ecosystem inefficiencies are reduced.

Agriculture Infrastructure Fund Scheme Features

- The scheme will be converged with every central and state government scheme.

- The officials have provided a single-window facility by collaborating with lending institutions.

- Projects will get handholding support from the Project Management Unit.

- The size of the finance facility is Rs. 1 lakh crore.

- The officials also provide a Credit Guarantee for loans up to Rs. 2 Crore.

- The authority will provide Interest Subvention of 3% per annumber, which is limited to Rs. 2 Crore per project; the loan amount can be increased.

- Various lending institutions are part of schemes like RRBs, Commercial Banks, Small Finance Banks, etc.

- If a person puts up projects in a different place, all those projects will become eligible under the Rs. 2 Crore loan scheme.

- Private Sector Entities like start-ups, farmers, etc. can apply for a maximum of 25 projects.

- There is no limitation of 25 projects for state agencies, federations of FPOs, federations of SHGs, etc.

- APMCs with multiple projects conducted within the designated market areas are eligible for the scheme.

- The Interest subvention will be provided for a total of seven years only.

- The repayment of a loan under this financial facility can vary from at least six months to a maximum of 2 years.

- The disbursement will be completed in six years, starting from 2020-21.

Required Documents for the agriinfra.dac.gov.in Fund Scheme

Here is the list of documents that will be needed to apply for the कृषि अवसंरचना निधि योजना:

| Bank’s loan application form/ Customer Request Letter for AIF Loan | Records of Land Ownership |

| Promoter/ Partners/ Director’s Passport Sized Photographs | Company’s ROC Search Report |

| Photo Identification Card (Aadhaar card, Driving license, etc.) | Promoter/ Firm/ Company’s KYC Document |

| Address Proof: Residence (Aadhaar card, Driving license, Electricity Bill, etc.) and Business Office/ Registered Office (Electricity Bill, Latest Property Tax Receipt, etc.) | Last One Year’s Bank Statement Copy |

| Proof of Registration | Repayment track record of existing loans |

| Last Three Year’s Income Tax Return | Promoter’s Net Worth Statements |

| Last Three Year’s Audited Balance Sheet | Detailed Project Report |

| Certificate of GST | Local authority permissions, Layout plans/ estimates, Building Sanction (If Applicable) |

Agriculture Infrastructure Fund Allocation Details

| State/UT | Tentative Fund Allocation (Rs. Cr) |

|---|---|

| Uttar Pradesh | 12831 |

| Rajasthan | 9015 |

| Maharashtra | 8460 |

| Madhya Pradesh | 7440 |

| Gujarat | 7282 |

| West Bengal | 7260 |

| Andhra Pradesh | 6540 |

| Tamil Nadu | 5990 |

| Punjab | 4713 |

| Karnataka | 4525 |

| Bihar | 3980 |

| Haryana | 3900 |

| Telangana | 3075 |

| Kerala | 2520 |

| Odisha | 2500 |

| Assam | 2050 |

| Chhattisgarh | 1990 |

| Jharkhand | 1445 |

| Himachal Pradesh | 925 |

| Jammu & Kashmir &Ladakh | 900 |

| Uttarakhand | 785 |

| Tripura | 360 |

| Arunachal Pradesh | 290 |

| Nagaland | 230 |

| Manipur | 200 |

| Mizoram | 196 |

| Meghalaya | 190 |

| Goa | 110 |

| Delhi | 102 |

| Sikkim | 56 |

| Puducherry | 48 |

| A & N Islands | 40 |

| Daman & Diu | 22 |

| Lakshadweep | 11 |

| Dadra & Nagar Haveli | 10 |

| Chandigarh | 9 |

| Total | 1,00,000 |

How to register at the National Agriculture Infra Financing Facility?

All readers interested in becoming a part of the scheme can register by following a certain process. The below steps will help in registering for the Agriculture Infrastructure Fund Scheme:

- Start the process by visiting the authorized website of the National Agriculture Infra Financing Facility at this link address: https://agriinfra.dac.gov.in/

- Next, scroll down the home page and locate the beneficiary Corner attached at the right side of the screen.

- Under that, you must click on the option named Beneficiary Registration to open a new page on the same screen.

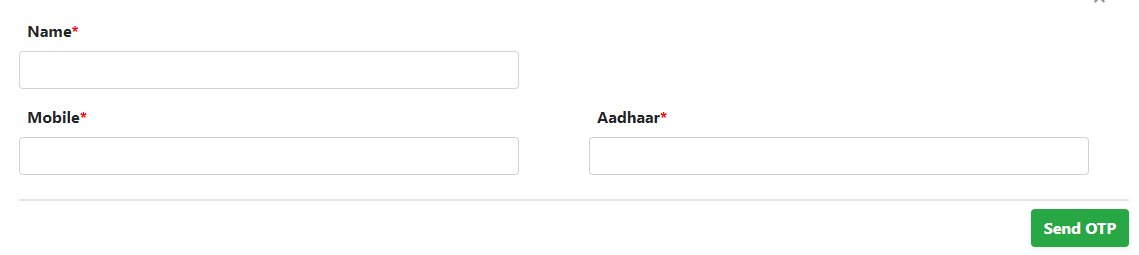

- After that, you must provide your name, mobile number, and Adhaar Number to get the OTP on your mentioned mobile number.

- Enter the received OTP on the available space and complete the verification process.

- After that, you will have to provide more details such as beneficiary type, address, and others carefully. Then tap on the submit tab.

- Finally, you are successfully registered at the National Agriculture Infra Financing Facility.

How to log into the National Agriculture Infra Financing Facility?

After the successful registration, candidates will be allowed to log into the portal. Here are the steps through which the beneficiary’s dashboard will form on the screen:

- Commence the procedure by opening the home page of the National Agriculture Infra Financing Facility Portal through this link i.e., https://agriinfra.dac.gov.in/

- Now, go to the beneficiary corner and click the Login link in that section.

- Now, the device will open the login page on the respective device.

- Provide the required credentials and submit them.

- The login process will be completed within a few seconds, and the dashboard will open.

How to apply for the Agriculture Infrastructure Fund Scheme 2023?

Candidates must follow a certain procedure to apply for the scheme mentioned above. Here is the detailed procedure explained step-by-step:

- The first step will be visiting the National Agriculture Infra Financing Facility Portal.

- The next step will be registering yourself as a beneficiary, and the process can be checked in the above paragraph.

- After that, you must go to the Beneficiary option, and a drop-down menu will open.

- Please click on the DPR Template option and save it.

- Now, you must log into the portal by providing your login credentials.

- Afterward, the dashboard will open where you must tap on the Loan Applications option and then the Apply Loan option.

- After that, start entering the details related to the project carefully and recheck before proceeding further.

- Now, fill out the DPR and upload the same to the application form in PDF format.

- Finally, tap on the submit option to submit the application form.

Contact Details

| Shri Samuel P.Kumar, Joint Secretary, Department of Agriculture and Farmers Welfare, Krishi Bhawan, New Delhi 110001. Email ID- sampraveen.04@gov.in Telephone Number- 011-23389909 | Shri K. R. Meena, Director, Department of Agriculture & Farmers Welfare. Krishi Bhawan, New Delhi 110001. Email ID- krmeena@ord.gov.in Telephone Number- 011-23386224 |

Central PMU:

- Helpline for Applicants: 011-23604888, Email ID: shubham.sharma@nabcons.in

- Helpline for Bank Officials: 011-23604914, Email ID: Bimbadhar.Mishra@nabcons.in

- Helpline for State Officials: 011-23604884, Email ID: shubham.sharma@nabcons.in

Agriculture Infrastructure Fund Scheme 2023: Important Links

| Visit the Portal | National Agriculture Infra Financing Facility Portal |

| Register Now | National Agriculture Infra Financing Facility Registration Link |

| Login | Agriculture Infrastructure Fund Login Link |

| Download | Beneficiary DPR Template PDF |

| Get the latest updates on | Pmmodiyojanaye, Home Page |

Frequently Asked Questions

Below mentioned institutions are eligible to participate in the scheme:

All scheduled Commercial Banks, Scheduled Cooperative Banks, Regional Rural Banks (RRBs), Small Finance Banks, Non-Banking Financial Companies (NBFCs), National Cooperative Development Corporations (NCDC) and DCCBs with PACS affiliation.

Registered users will have to provide the User ID/ Beneficiary ID, Password, and Captch code to log into the National Agriculture Infra Financing Facility Portal.

The following are the eligible projects for building community farming assets:

Hydroponic Farming, Mushroom farming, Vertical farming, Aeroponic farming, Poly house/ Greenhouse, and Logistics facilities (including non-refrigerated/ insulated vehicles)

As per the official guidelines, the Department of Expenditure will revisit the scheme after the distribution of Rs. 20,000 crores for evaluation and midcourse correction if needed. The officials will conduct the mid-term third-party independent evaluation when it will be required.

All participating lending institutes will be setting the criteria for the selection of eligible borrowers after the consultation of monitoring committers and Nabard. The eligibility will be set after considering the viability of the projects to avoid NPA.